One of the most widely used methods for valuing a company is the discounted cash flow (DCF) model. While the average investor might assume that this is a sophisticated technique for Wall Street analysts, retail investors can leverage the powerful tools and data sources available to them to create their own DCF models. The core concepts are actually quite straightforward.

A DCF model makes it possible to estimate a company's intrinsic value based on its projected future cash flows. This allows you to look past day-to-day market moves and make investment decisions based on your estimate of a company's fundamental value.

Present value is the heart of the DCF

Before starting to build a model, it’s vital to understand a crucial concept: the time value of money. In the simplest terms, a dollar today should be worth more than a dollar tomorrow. Why? Because you can invest that dollar today and start earning a potential return on it. This principle drives the DCF analysis.

Imagine someone offers you a choice: $100 today or $100 a year from now. You would almost certainly take the money today. But what if the choice was $100 today or $110 in a year? Now the decision is more complicated. If you believe you can earn more than a ten percent return on your money over the next year, you’d still take the $100 today. If not, you’d wait for the $110.

Calculating present value

There’s a simple formula used to calculate present value, in which:

PV = present value

FV = future value

r = interest rate

n = number of periods (years or months)

PV = FV (1 + r)n

As an example, let’s say that you want to have $1,000 in five years and the annual interest rate is 5%. How much money do you need to invest today in order to get there?

PV = $1,000/ (1 + .05)5

PV = $1,000/ (1.27628)

PV = 783.53, so you would need to invest $783.53 at an annual rate of 5% to have $1,000 in five years.

This is the essence of present value. It's the current worth of a future sum of money, given a specified rate of return. The DCF model works by projecting a company's future cash flows and then "discounting" them back to what they are worth today—their present value.

Forecasting the future: building pro forma statements

The most challenging part of a DCF analysis is forecasting a company's future performance. Past performance of any company is no guarantee of future results, and no one can predict the future with absolute certainty. With that in mind, forecasting involves creating simplified future (or "pro forma") financial statements. The goal is to project the company’s free cash flow (FCF)1, which is the cash a company generates after accounting for the cash outflows to support operations and maintain its capital assets.

A common way to calculate FCF is:

Free cash flow = Net operating profit after tax (NOPAT) + Depreciation & amortization – Capital expenditures – Change in net working capital

All the information you need to calculate free cash flow can be found on the income statement and balance sheet.

Working capital (WC) = Current assets – Current liabilities (balance sheet)

Change in WC = Current period WC – Previous period WC

Forecasting key components of the financial statements

Revenue growth: Start by looking at the company's historical revenue growth over the past five to ten years. Has it been accelerating or slowing down? Read analyst reports and company guidance to understand management expectations and industry trends. For a stable, mature company, you might forecast a growth rate similar to GDP. For a younger, high-growth company, you might project a higher rate that gradually declines over time. Or you might use the average growth rate for the historical period. The factors used to inform an estimate can vary by industry, so it’s important to do careful research to support your projections.

Operating expenses: Look at the company's historical profit margins. Have costs like sales, general, and administrative expenses been a stable percentage of revenue? Many often assume these relationships will remain consistent, unless you have a strong reason to believe otherwise (e.g., a major restructuring).

Capital expenditures (CapEx): This is what the company has spent on physical assets like buildings and equipment. You can find this figure on the cash flow statement. Look at CapEx as a percentage of revenue historically and account for any announced plans for new capital projects. Companies need to reinvest in themselves to grow, so this figure is critical.

The forecast period is typically five to ten years. The longer the forecast period, the more nebulous projections become. It’s important to be realistic and conservative with your assumptions. Any model is only as good as the assumptions on which it is based, so you need to do as much research as possible to support your estimates.

Choosing an appropriate discount rate

Once you have created pro forma financials and have future cash flow projections, a "discount rate" is necessary to determine the present value of the cash flows. The discount rate must reflect the risk associated with the investment. A riskier company demands a higher discount rate, which results in a lower present value for its future cash flows.

Professional analysts often use the weighted average cost of capital (WACC)2. This formula blends the cost of a company's debt and equity. While calculating a precise WACC can be complex, there is a simplified approach that should work for retail investors.

A practical method is to use your personal required rate of return. What annual return do you expect from your investments to make them worthwhile? For many stock market investors, a rate between eight and twelve percent is a common target.

- 8–10%: You might use this for a stable, blue-chip company with predictable earnings.

- 10–12%+: This might be more appropriate for a smaller, higher-growth company with greater uncertainty. Risker companies should be valued using higher discount rates than low-risk companies.

This rate acts as a hurdle. If the company's expected return doesn't clear this hurdle, it may not be a suitable investment for you. The discount rate has a huge impact on the final valuation, so it's important to be thoughtful and consistent.

A step-by-step guide to building a DCF

Let's put it all together. Here are the steps for building your own DCF model.

Step 1: Gather historical data

Collect the company's financial statements (income statement, balance sheet, cash flow statement) for the last give years from sources like Yahoo Finance, Seeking Alpha, or the company’s own investor relations website.

Step 2: Create pro forma financial statements

Pro forma financials are your projections for a company’s performance. Use the historical data along with detailed company and market research to build your financial statements. Start with forecasting revenue, then use historical averages as a percentage of revenue to calculate costs, net income, and other line items for the income statement.

Next, create a pro forma balance sheet by projecting assets, liabilities, and equity based on expected changes. Again, use historical averages of percentage of assets to build out the line items.

Finally, prepare a pro forma cash flow statement to track inflows and outflows. Consider your assumptions carefully to make sure they’re realistic and consistent with market trends.

Step 3: Calculate historic free cash flow

For each of the past five years, calculate the company's free cash flow. This will give you a baseline and help you understand its cash-generating ability.

Step 4: Forecast future free cash flow

Use your pro forma financials to build a cash flow statement for each year in the valuation period. Your FCF projections for each year form the basis of the valuation.

Step 5: Calculate terminal value3 (TV)

You can't forecast forever. The terminal value estimates the company's value for the years beyond the forecast period. A simple way to do this is to treat the final year cash flow as a perpetuity, assuming that it will grow at a slow, steady rate (like the rate of inflation, e.g., 2–3%) forever.

Here’s how to calculate the value of a perpetuity:

PV = Present value

C = Cash flow

r = Discount rate

g = Growth rate

PV = C/(r-g)

Step 6: Discount all cash flows to present value

Using your chosen discount rate, calculate the present value of each of your forecasted cash flows (from Step 3) and the present value of your terminal value (from Step 4).

Step 7: Calculate intrinsic value and compare

Add all of the present values together. This total is the company’s estimated intrinsic value. Divide this number by the number of shares outstanding to get the intrinsic value per share. Then, compare this value to the current stock price. If your calculated value is significantly higher than the market price, the stock may be undervalued.

Step 8: Refine the valuation with sensitivity analysis

To determine how the valuation may vary with changes in estimates, you may want to create several versions of the DCF, typically high, low, and steady state. You might try using different growth rates or discount rates, for example, to see how your valuation model reacts to changes in these variables.

The takeaway

When you build a DCF model, you step into the business owner’s shoes. It helps you understand the factors that drive a company’s value by taking a deep dive into the company’s financials. You must understand the competitive landscape and industry dynamics. It takes deep research to understand a company well enough to make projections about its future.

The real benefit of building a DCF model lies in the process. Start with a company you know well. Practice building models, testing your assumptions, and seeing how altering estimates can change the final valuation. Over time, you’ll refine your judgment and gain a powerful new skill to deploy as a value investor.

Sources:

1 Investopedia, Free Cash Flow (FCF): How to Calculate It and interpret It, June 15, 2025, Accessed September 9, 2025

2 Investopedia, Understanding WACC: Definition, Formula, and Calculation Explained, August 17, 2025, Accessed September 10,2025

3 Investopedia, Terminal Value: Definition and Formula, May 17, 2025, Accessed September 10, 2025

Related Posts

Valuation: How to Build a Simple Discounted Cash Flow Model

One of the most widely used methods for valuing a company is the discounted cash flow (DCF) model....

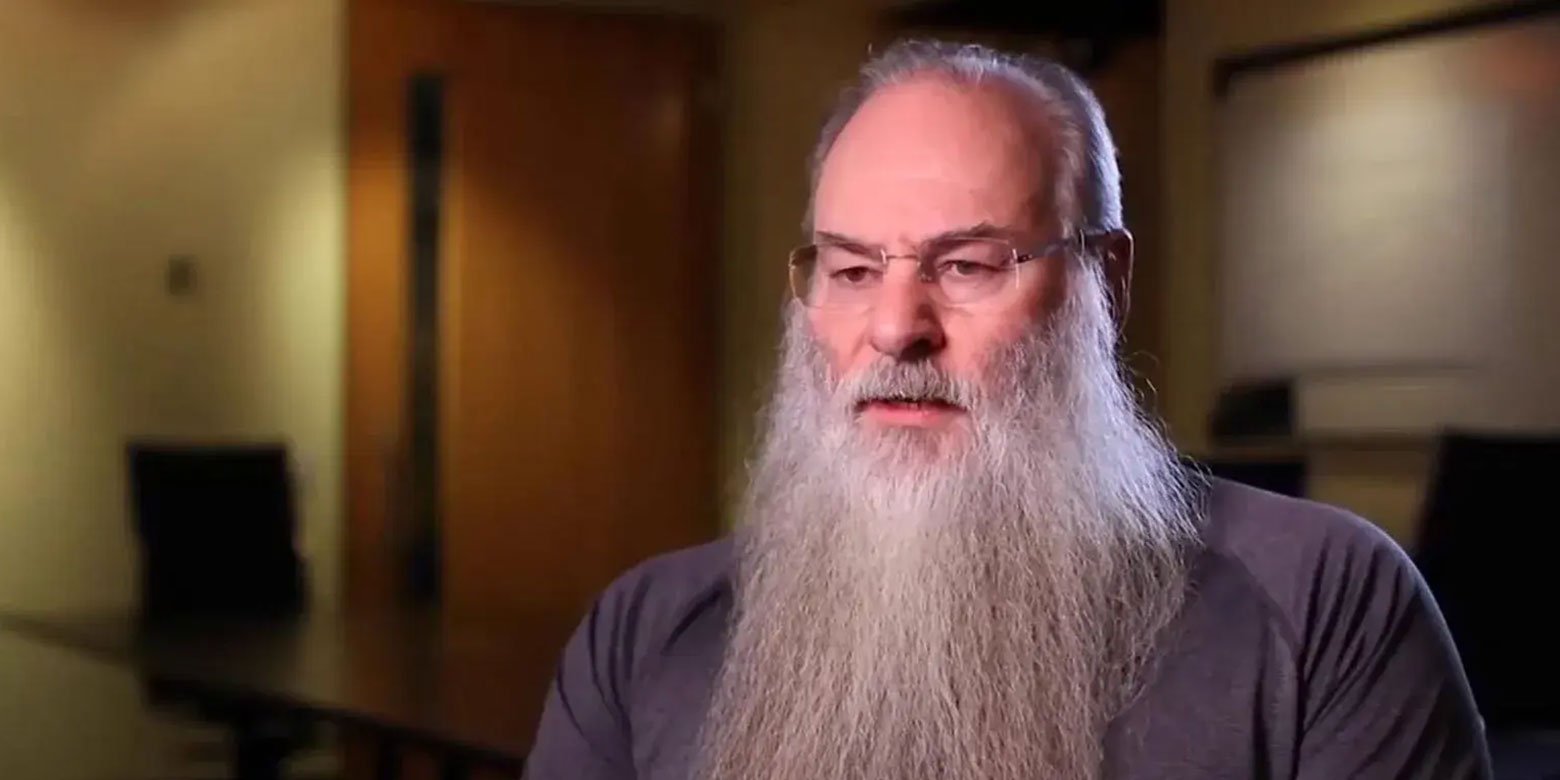

The Best Investor You’ve Never Heard Of

Mann on the Street

2025 is the year one of the greatest capital allocators in history hangs up his abacus.

Interested in more?

Get our popular newseltter delivered to your inbox every month.

Search the Insights Blog

How to invest with us

Click the button below to learn how you can get started with Motley Fool Asset Management