2025 is the year one of the greatest capital allocators in history hangs up his abacus.

Oh, I know, I know, you think I’m talking about Warren Buffett, the legendary Chairman of Berkshire Hathaway*, who used insurance float to turn a small pile of money into a massive pile of money. Yes, his retirement has rippled through the investing world, and to me he is the greatest. But c’mon, Warren Buffett is 95 years old and has plied his trade for the benefit of Berkshire's shareholders for far longer than we had a right to expect.

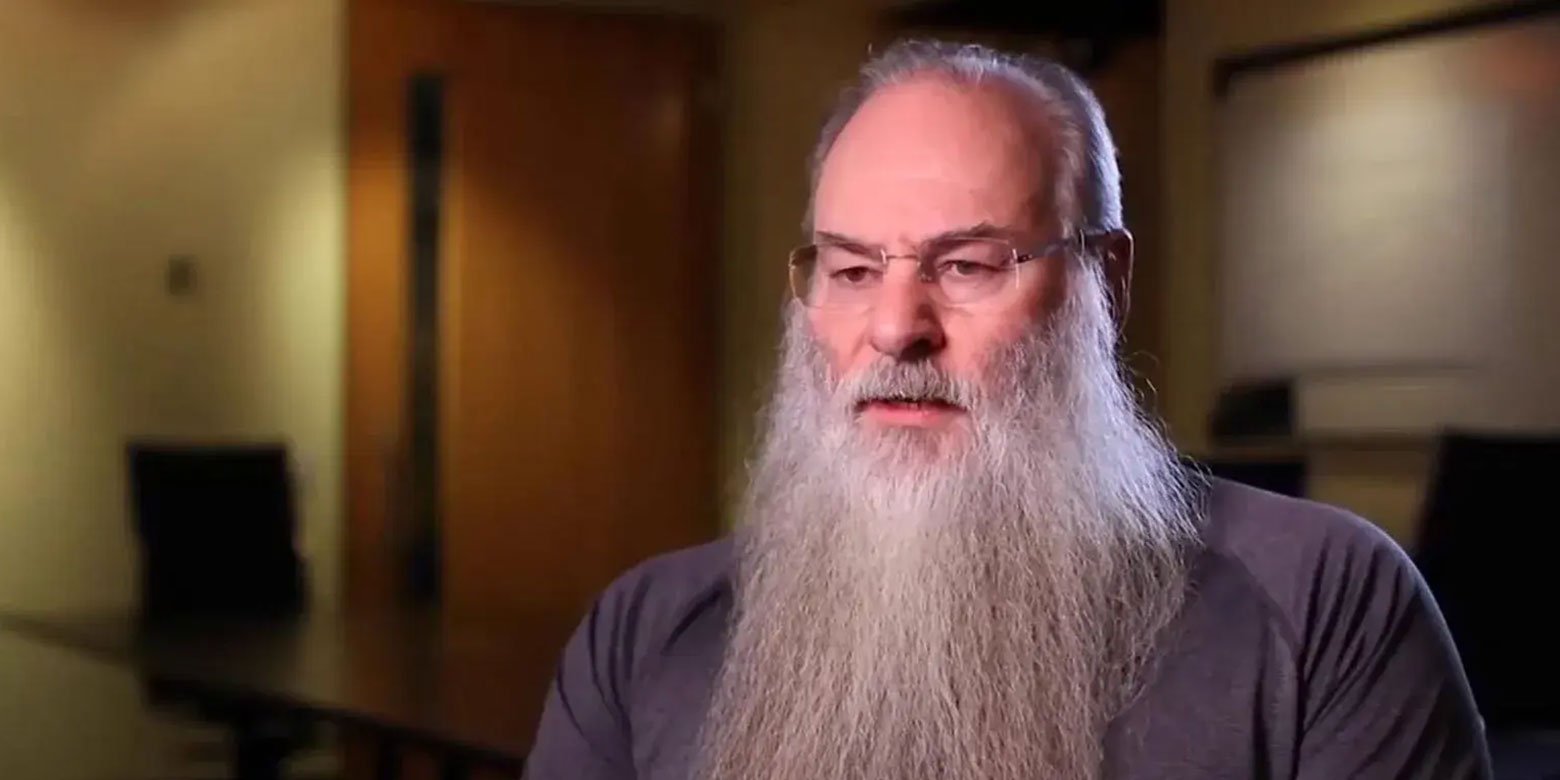

But—to paraphrase Yoda—there is another. His name is Mark Leonard, and if you’ve never heard of him, you’re not alone. There are only a few photos of him to be found. He’s not media shy—he’s North Korea-level media shy.

At the end of September he announced that he was stepping down from the company he founded in 1995, Constellation Software*. Mark Leonard is 69 and his stated reason for stepping down is “health concerns.”

This minimal explanation is totally on brand for Leonard. I could find only one instance of him granting an interview (which is here, and amazing).

You’ve also perhaps never heard of the company he founded and has led since 1995, and not just because it’s Canadian. Both words—“Constellation” and “Software”—are meaningful in this case, because both are descriptors rather than brands. You can’t buy software from a company called “Constellation.” The name refers to the philosophical underpinnings of the enterprise, built in the image of Mark Leonard, a constellation that spans more than 500 vertical management software companies.

And even though these are companies that you could buy software from, it’s unlikely you’ve heard of them either, even if you’re the kind of person who buys lots of software. The kinds of software companies in the Constellation constellation do things like manage hair salons and bowling alleys. And this, perhaps, is where we get into the genius and iconoclasm of Mark Leonard.

In 1995 he left a career in venture capital with $25 million in seed capital and an idea to build a portfolio of software firms that were essential to niche industries, and then use the cash their existing portfolio companies spun out to acquire other VMS companies. This wasn’t a guess—Mark Leonard had noticed that his VC firm’s best performing investments tended to be VMS companies, due in part to the fact that they tended to be critical, irreplaceable vendors to their clients. The problem with many of these companies, though, was that they were small enough that they were fairly meaningless to the overall performance of the portfolio.

This article does not constitute personal advice. You should seek advice for any investment before you buy it as investments in any form will rise and fall in value, so you may get back less than you put in. Past performance is not indicative of future return.

Also keep in mind that we are talking about the historical performance of an individual company. Owning individual companies isn’t for everyone because if that company fails you could lose your entire investment.

Leonard’s idea was to create a company that only purchased VMS companies, and then use their free cash flow to rinse and repeat. When Constellation Software bought these companies, by and large it would leave their current operators to go about their business. Constellation didn’t even interfere when two or more of its wholly owned subsidiary companies were competing over the same customers.

Diagram from Constellation Software’s IPO Prospectus, 2006

Diagram from Constellation Software’s IPO Prospectus, 2006

It was a unique strategy for growth—buy small, highly profitable companies with limited growth prospects (and, as such, limited requirements for reinvestment). For the acquirer it requires a super-cliched attribute: discipline. I suspect that Leonard would love being described in such an accurate yet vague way.

And yet for a company that grows through the force multiplier of capital redeployment, there can be no greater business requirement than discipline, particularly given the fact that as Constellation Software grew, each additional acquisition would move the needle less and less. They need their wins to be just good enough, their losses to be meaningless and/or rare, or best of all—both.

The proof is in the pudding for Constellation Software—in the intervening 30 years the company grew more than 3600 times in value and generated returns for shareholders (Constellation Software held its IPO in 2006 in order to create exit liquidity for its investees) of nearly 200X (including dividends).

We tend to think of the massive winners in the market as having some insurmountable edge: an ironclad brand, superior technology, a wildly growing market. It turns out, though, that the insights that fueled Mark Leonard’s perpetual motion machine were much more mundane.

This isn’t a story of a genius product, or good timing, or fantastic branding or any of the multitude of ways we think of when considering successful companies. Instead, Mark Leonard simply built a company with a different mindset than any of his competitors, so much so that most likely no company of any real size considered Constellation Software to be a competitor.

The word “simply” is carrying a lot of weight in the previous paragraph. Because at each turn Mark Leonard had to resist a multitude of institutional imperatives as well as some incredibly attractive short cuts. After all, for an acquirer that bought hundreds of smaller firms, there must have been a substantial number of high-quality companies that didn’t quite fit their criteria.

- Being a good partner to your investee companies can be a great way to attract other potential acquisitions. When your company’s acquisition criteria only allows for what are essentially below-market acquisitions, you’ll remain attractive by allowing your investees to prosper post-transaction.

- Shareholder capital is sacred. A few years back Mark Leonard—a millionaire many times over—announced that he would now occasionally fly business class after decades of flying coach.

- The competitive advantage of the investees mattered more than that of the acquirer. Constellation Software’s only competitive advantage was its willingness to fish in waters where few others tended to bother. Otherwise literally any other investor could do what they were doing.

- Let ‘em cook. Constellation Software’s core operations team is tiny and could remain so because it so rarely needed to intervene in the operations of its investee companies. They historically haven’t even interceded if those companies competed directly with one another.

- You get the shareholders you deserve. Mark Leonard occasionally commented in shareholder letters about Constellation Software’s share price—to note that it was too high. He also was not a fan of marketing the stock or even, really, explaining the company, and even had qualms about the fairness of share buybacks. And though Constellation Software has generated tremendous cumulative returns, it hasn’t been a straight line, with shares dropping at one point as much as 30%. Conversations with the investing public were restricted to Constellation Software’s annual letters.

These are pretty simple insights that, in combination, have generated market-beating returns for Constellation Software shareholders. We may not come across another Mark Leonard in our investing careers—and there is no guarantee that his successors at Constellation Software will successfully follow his model, so, you know, this shouldn’t be construed as a recommendation to buy the shares—but the formula is there waiting to be emulated.

I wish all the best of health and happiness to Mark as he enters the next phase of his life. His work at Constellation Software speaks for itself.

Related Posts

Market Predictions are Futile

Mann on the Street

A few years ago I got to hear JPMorgan CEO Jamie Dimon give a talk at a conference in Hong Kong,...

The Hidden Cost of Chasing Trends

Identifying a major investment trend before it hits the mainstream feels like finding buried...

How Can ETFs Help Investors Avoid The Wash Sale Rule?

Selling an investment at a loss can be smart tax planning—but only if you don’t accidentally give...

Interested in more?

Get our popular newseltter delivered to your inbox every month.

Search the Insights Blog

How to invest with us

Click the button below to learn how you can get started with Motley Fool Asset Management