Businesses, both public and private, frequently need to raise capital. While that often means working with traditional banks or venture capital firms, there’s another option: private credit.

Private credit is a process where individuals, funds, or other nonbank entities lend money to fund a private business. Often, borrowers prefer this type of financing because it can have more flexible terms and repayment schedules.

Private credit can also be an investable asset. In recent years the number of private credit funds has increased markedly, including funds available to non-accredited (i.e., individual) investors.

Let’s talk about what it is, why it might be an attractive investment, and how you can invest in private credit.

An alternative investment

Private credit is considered a type of alternative investment, and it offers a relatively low correlation to more traditional asset classes like stocks and bonds.

Private credit is relatively illiquid, with the lenders or investors who supply some of the funds getting their money back via interest payments made by the borrowers or the maturity and repayment of the debt. In some cases, the debt may be refinanced or purchased by another investor, paying off the first set in the process. In addition, some private equity investments may offer opportunities for periodic redemptions.

Private credit versus private equity

You’re probably more familiar with the term private equity, but it’s important to differentiate that from private credit. Private equity involves investors and others taking a public company private, or in some cases buying a stake in a company that is already private.

Private equity investors believe that by taking these companies private (or investing heavily in them), the companies can improve their operations and/or finances and the private equity investors can potentially benefit from improved profitability and possibly going public with these companies in the future.

In private equity, the benefit often comes years down the road, when the company goes public or buys out the debt. In private credit, investors enjoy returns on a regular schedule as the debt is repaid with interest.

Should you invest in private credit?

There are several potential benefits of investing in private credit.

- Low correlation to traditional asset classes like stocks and bonds: Private credit is an alternative asset and can be a useful part of an investor’s efforts to diversify their portfolio away from only holding traditional stocks and bonds.

- The potential for higher yields: Private credit funds often have higher yields than traditional investment-grade fixed-income vehicles. This is due in part to the fact that private credit is often extended to small and mid-sized businesses that might not have a solid credit history.

- Lower volatility: In many cases, private credit funds have the potential for less volatility than other high-yielding bonds and fixed-income vehicles. This potential lower volatility can provide a degree of downside comfort for investors.

Like all investing, investing in private credit has potential disadvantages as well.

- Higher costs: Many funds that offer access to private credit investments for non-accredited investors carry higher fees and expenses than funds that invest in other types of fixed-income securities.

- Liquidity issues: While ETFs that invest in private credit will have a high degree of liquidity, other types of private credit funds and investing platforms offering access may not offer the same type of daily liquidity. This is an important consideration for investors, especially when liquidity is a key issue for them.

- Potential risks in a down market: Since accessible private credit funds, platforms, and ETFs are all relatively new, we don’t necessarily know how these investments will perform in an extended down market or economy. This is especially important in situations where investors have limited access and liquidity.

Accessible ways to invest in private credit

While private credit may sound daunting, there are several ways for individual investors to dip their toes.

ETFs

There are a growing number of ETFs that invest exclusively in private credit, or in which private credit is included at a significant level. As with other types of ETFs, you can access private credit simply by buying shares of the ETF through your brokerage account. ETFs also offer liquidity that generally wouldn’t be an option with direct investment in private equity.

Your exposure to private credit is dependent on the underlying holdings selected by the fund’s manager. When looking at an ETF with exposure to private credit, there are several things you’ll want to evaluate.

- What percentage of the ETF’s assets are devoted to private credit holdings?

- What is the fund’s expense ratio? The variance in the expense ratios of ETFs in this segment of the market is huge, from 70 basis points up to over 10%.1

- How does the ETF invest in private credit? Common options are via the use of collateralized loan obligations (CLOs) or business development companies (BDCs). They might hold private credit obligations directly. Understand the layers involved between you and private credit.

Note that while many ETFs in this sector are actively managed, there are some that track an index entirely or in part. Be sure that you understand either the index being tracked or the management philosophy to determine if this particular ETF is a beneficial holding for you.

Interval funds

Interval funds combine some of the characteristics of both open-end mutual funds and closed-end funds. Interval funds can be purchased on any day when the markets are open, but shareholders can only redeem them on a limited basis, often quarterly.

Interval funds on average are more expensive than most open-end mutual funds and ETFs. According to Morningstar in 2024, the average expense ratio across all interval fund share classes was 2.49%, compared with 0.58% and 0.99% for ETFs and open-end mutual funds, respectively.2

The benefit of interval funds is that by allowing investors to buy shares when the market is open—but only letting them sell shares at specified times—the manager can invest for longer time periods without worrying about outflows.

Investing platforms

A number of investing platforms offer access to private credit investments for individual, non-accredited investors.

- Fundrise allows investors to invest in a variety of alternative funds, including private credit, real estate, and venture capital. These funds have low minimums and are open to non-accredited investors. There may be penalties if the money is redeemed in the fund too early, which usually means within five years.

- Yieldstreet is another platform offering investors access to a variety of alternative assets, including private credit, private equity, real estate, venture capital, art and collectibles, and a host of others. For non-accredited investors, the minimum investment is typically $10,000. There’s generally a lock-up period during which money invested cannot be accessed without a penalty.3

There are a number of other investing platforms that allow non-accredited investors the opportunity to invest in private credit and other types of alternative investments, generally via a fund offered on the platform.

Investors considering this option will want to review the fund’s performance, the required investment level, and the rules surrounding fund access and liquidity. Fund expenses should also be reviewed, as they can vary.

The future and moving forward

Non-accredited and non-institutional investors looking to invest in private credit funds and ETFs must remember that many of these more accessible funds and platforms are in their relative infancy. The growth of accessible private credit vehicles has been strong over the past few years, but they’re still fairly new.

While we can’t predict the future, it seems likely to us that there will be an expansion in accessible private equity investment options in the next few years. Hopefully these will offer greater liquidity and lower costs. If this is of interest to you, it makes sense to follow this space closely.

Sources:

1 VettaFi. Private Credit ETF List. Accessed September 8, 2025.

2 Morningstar. “Interval Funds: Are they worth what you give up?” Accessed September 8, 2025.

3 Yieldstreet Accessed September 8, 2025.

Related Posts

Investing in Private Credit—What to Know

Businesses, both public and private, frequently need to raise capital. While that often means...

Valuation: How to Build a Simple Discounted Cash Flow Model

One of the most widely used methods for valuing a company is the discounted cash flow (DCF) model....

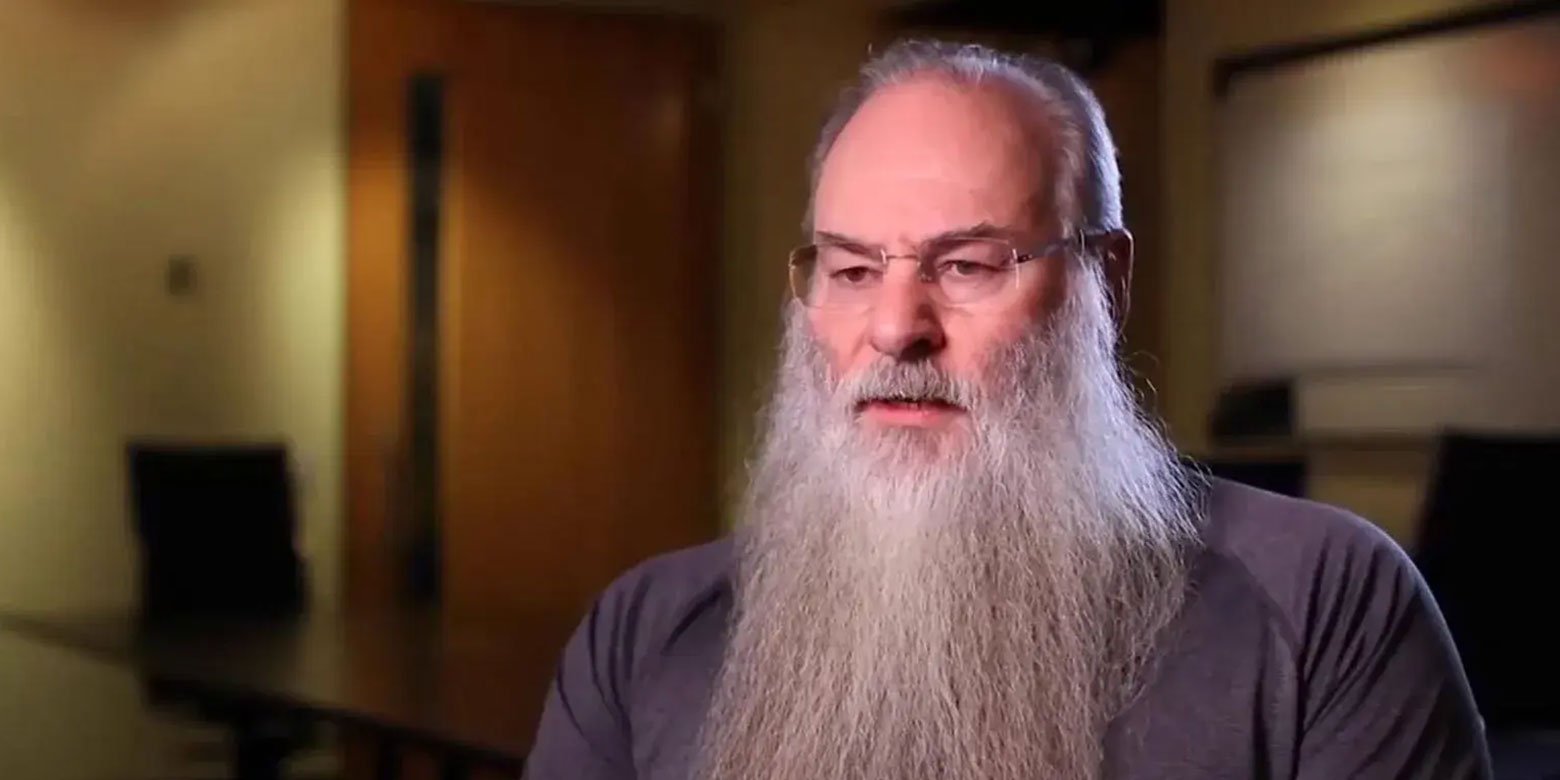

The Best Investor You’ve Never Heard Of

Mann on the Street

2025 is the year one of the greatest capital allocators in history hangs up his abacus.

Interested in more?

Get our popular newseltter delivered to your inbox every month.

Search the Insights Blog

How to invest with us

Click the button below to learn how you can get started with Motley Fool Asset Management