If you’re like many Americans, you’re worried about the future of the country.

We’re in the midst of yet another extremely contentious election season, and emotions are running high. Regardless of where you fall on the political spectrum, it’s right to be paying attention and to be concerned about what the future might hold.

We’re navigating this uncertain landscape as citizens ourselves.

As investors, though, we believe it’s important to approach investing separate from our political passions. We’ve identified three major pitfalls around politics and investing that we think could seriously harm your financial future.

Pitfall #1: Beware anyone who claims the outcome is obvious.

When you're a politician or political pundit, having strong convictions is essential to the gig.

You can likely imagine someone on a debate stage or a morning talk show right now saying, “Look… it’s not complicated…”

Let’s stop right there: The investor knows that whatever “it” may be, “it” is always complicated.

Inflation, interest rates, labor, and energy costs are top of mind for many investors and consumers, and all of them can affect one another.

In addition, the direction of the stock market can often be out of sync with the direction of the economy. The market doesn’t always go down when the economy is challenged (hello, COVID times) or go up when the economy is humming.

This lack of a predictable sync is another reason we like to focus on the strength of companies over the perceived strength of the nation’s economy or the supposed pro-business proposals touted by Republicans and Democrats alike.

While any given piece of legislation or legal decision can cause real economic impacts or ripples in the stock market, predicting how those ripples will actually play out is a (lowercase f) fool’s game.

Often, the impact of a given policy isn’t fully felt for years, and its effect cannot be fully understood except in hindsight. Even then, those effects may be the subject of extensive debate.

That doesn’t mean we should simply bury our heads in the sand. Our investing team looks at shifting parties and policies and assigns probabilities to multiple future scenarios we think might unfold.

We listen for the possible impacts Washington policies may have on the companies we hold during the quarterly earnings calls, and keep careful tabs on how our holdings respond to new legislation or regulations.

Because no one can really see the future, our goal is to find companies that we believe can thrive in the multiple future scenarios we think are possible. That’s why we prefer to spend our time debating the quality of companies: their leadership, their vision, their fundamentals, their competitive advantages, and their trajectories.

Pitfall #2: Beware those who would prey on your passions.

Because we strive to remain objective and dispassionate, professional investors are often accused of being selfish, callous, or heartless.

And while we can at times slip into jargony language and/or sound like robots, rest assured that we are in fact concerned citizens just like you. And each of us are passionate about different causes.

But our job isn’t to push our own agendas. Our job is to help steward your resources toward the financial freedom you seek.

It’s safe to say that many of our Portfolio Managers, Investment Analysts, and other team members have been discouraged, depressed, and concerned about the state of our country’s politics.

But we’ve never considered pulling our money out of the market. Not once.

And we’d be very wary of anyone who advised you to do so.

Often, as humans, we can feel so strongly about our political positions that we think every aspect of our lives ought to align with them. This impulse makes a lot of sense. Why wouldn’t we put our money where our mouths — and hearts — are?

But, your genuine passion may also be ripe for exploitation.

You might remember the story of the “anti-woke” bank advertised specifically toward a market of strongly conservative consumers.1 That endeavor went belly-up in short order, mired in legal battles, including charges of fraud.

Perhaps a less extreme — but certainly more pervasive — example would be environmental, social, corporate-governance (ESG) funds, designed to attract consumers with strong convictions about environmental or social ethics. While studies show that strong ESG factors in a company do correlate with long-term outperformance,2 we believe the outperformance is less about those factors than it is about creating strong competitive advantages — one of our Pillars of Quality.

Once again, we think this is a case of appealing to the emotions of the investor over their financial best interest, because it’s the combination of all Four Pillars — not just competitive advantage — that creates a strong investing thesis.

We believe good investing requires objectivity. Passion pointed in the wrong direction, in our opinion, can lead to rash decisions. And rash decisions can have very real consequences for your financial future.

Pitfall #3: Beware investment advice predicated upon the outcome of any given election. (Yes, including this one!)

You may remember hearing from some people that the election of Barack Obama would mean disaster for the country.

You might also have heard from others that Donald Trump would bring about our downfall as a nation.

And you may now be hearing about how President Joe Biden’s decisions are putting us on yet another perilous path.

Well, we survived Obama. And we survived Trump. And we’re surviving Biden.

We think we’ll survive the coming administration as well.

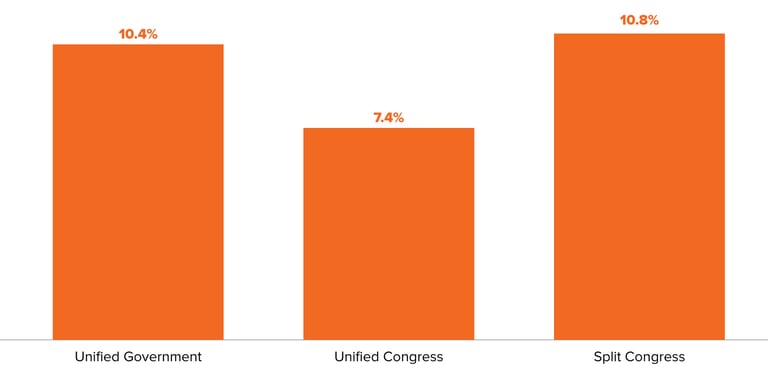

In fact, research has shown that, from 1933 to 2021, the S&P 500 has performed well regardless of the makeup of Congress and the White House.

S&P 500 Index - Average annual return (1933-2021)

Sources: Capital Group, Strategas. As of December 31, 2021. Unified government indicates control of the White House, House and Senate by the same political party. Unified Congress indicates control of the House and Senate by the same party, but control of the White House by a different party. Split Congress indicates control of the House and Senate by different parties, regardless of White House

Remember, the gulf between what a politician says they want to do and what a politician can actually accomplish is often vast.

Our system has an array of built-in checks and balances. And, historically speaking, whenever one party holds too much power, Americans tend to lean in the opposite direction and restore balance in the next election cycle. (It’s kind of like the stock market! When a stock gets too big for its britches, investors can tend to knock it back down to size.)

This can lead to some frustrating stalemates in Washington, D.C., but some would argue that the difficulty of changing too much too fast is quite by design, and is actually what allows successful U.S. businesses in particular to innovate and thrive.

What’s the Foolish bottom line?

It boils down to this: It's good and right to be passionately engaged as a citizen. Our elected officials and the policies they enact can make a real impact in the economy and, more importantly, in the lives of millions of people, including our families and communities.

At the same time, there is only so much sway even the most powerful people in the wealthiest nation on the planet can have.

From our perspective, we see global trends that we believe could force their way into relevance, regardless of who holds power. We see advancements in technology, energy, healthcare, and other industries whose momentum we believe is impossible to halt, and could shape our future reality.

It's our belief that investments in the companies at the forefront of such potentially unstoppable trends should make a strong foundation for your long-term portfolio, offering compounding gains over time.

Related Posts

Market Predictions are Futile

Mann on the Street

A few years ago I got to hear JPMorgan CEO Jamie Dimon give a talk at a conference in Hong Kong,...

The Hidden Cost of Chasing Trends

Identifying a major investment trend before it hits the mainstream feels like finding buried...

How Can ETFs Help Investors Avoid The Wash Sale Rule?

Selling an investment at a loss can be smart tax planning—but only if you don’t accidentally give...

Interested in more?

Get our popular newseltter delivered to your inbox every month.

Search the Insights Blog

How to invest with us

Click the button below to learn how you can get started with Motley Fool Asset Management

.jpg)