Sports betting has gone mainstream. But that doesn’t mean it’s easy. While some people may, on occasion, win a single game, when they parlay several games, the odds of winning are reduced exponentially.

Stock selection is similarly as hard. While an investor may get one or a few stocks right, selecting a portfolio of winners is not as easy.

That’s because market leadership is not static

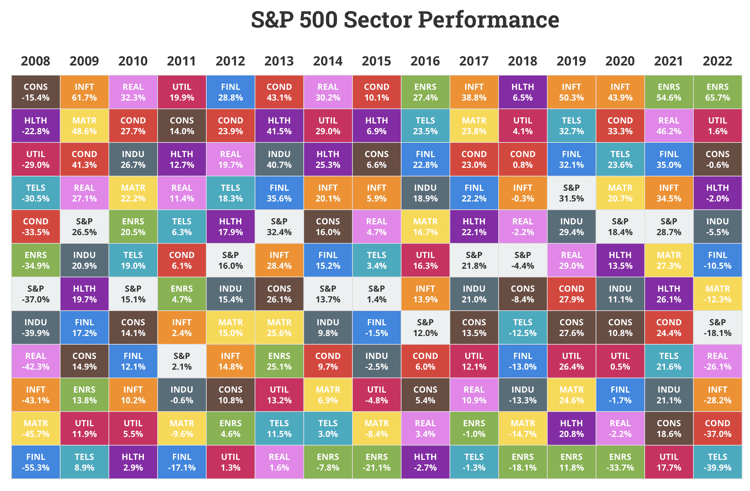

Just look at the chart below. We know, there are a lot of colors! But as they say, a picture tells a thousand words.

In order of best to worst performing, this chart ranks all of the market sectors represented in the S&P 500 compared to the S&P 500 index itself, for the last 15 years through December 31, 2022.

Source: novelinvestor.com. Past performance does not guarantee future returns. The historical performance is meant to show changes in market trends across the different S&P 500 sectors over the past ten years. Returns represent total annual returns (reinvestment of all distributions) and does not include fees and expenses. The investments you choose should reflect your financial goals and risk tolerance. For assistance, talk to a financial professional. All data are as of 12/31/22.

Source: novelinvestor.com. Past performance does not guarantee future returns. The historical performance is meant to show changes in market trends across the different S&P 500 sectors over the past ten years. Returns represent total annual returns (reinvestment of all distributions) and does not include fees and expenses. The investments you choose should reflect your financial goals and risk tolerance. For assistance, talk to a financial professional. All data are as of 12/31/22.

No, your eyes are not deceiving you! Sector winners are all over the map. For example, in 2018, healthcare was the top dog, but then in 2019, it was trolling near the bottom of the chart. Energy was the winner last year, and the year before, but it was the biggest loser according to this chart for the past three years from 2018 to 2020. The takeaway? There’s no discernable pattern.

So while the chart makes a lovely colorful quilt, it doesn’t exactly inspire confidence that picking the right sector will help drive long-term portfolio growth and minimize volatility.

But how can an active ETF manager create a fund that has the potential to perform well while considering sector rotation and market volatility?

Bottom-up fundamental analysis can be key

Unlike sports betting, which has many uncontrollables, finding what we believe is a Quality company is about doing your homework. Our active portfolio management team has developed a repeatable investment process that analyzes and scores companies using our Four Pillars of Quality framework:

- Management, culture, and incentives

- Economics

- Competitive advantages

- Trajectory

That doesn’t mean that we get every security selection right—no one does. But it does mean that we pick our investments based on individual company dynamics and their interplay with consumers, competitors, and the overall economy.

So even if overall sector returns are all over the map—as they tend to be—it often doesn’t matter to us because we strive to construct our portfolios with Quality companies and volatility minimization in mind, regardless of in which sector they may fall.

Related Posts

Market Predictions are Futile

Mann on the Street

A few years ago I got to hear JPMorgan CEO Jamie Dimon give a talk at a conference in Hong Kong,...

The Hidden Cost of Chasing Trends

Identifying a major investment trend before it hits the mainstream feels like finding buried...

How Can ETFs Help Investors Avoid The Wash Sale Rule?

Selling an investment at a loss can be smart tax planning—but only if you don’t accidentally give...

Interested in more?

Get our popular newseltter delivered to your inbox every month.

Search the Insights Blog

How to invest with us

Click the button below to learn how you can get started with Motley Fool Asset Management