Chances are you’ve heard of ETFs before. But do you feel you have a decent grasp of their ins and outs?

For instance if you’re approached at a cocktail party and asked how their taxes and fees differ from mutual funds, whether they’re always well diversified, if they are only passively managed, or if they are the same as index funds, could you hold your own? If not, we’d understand why. The details can be as elusive to grasp as a garden snake.

Here’s a quick primer on ETFs. We’ve included just enough details to make you confident to respond, “Let’s grab a drink and I’ll explain ETFs to you.”

What is an ETF?

ETF is short for exchange-traded fund. First introduced in 1993, this type of investment has grown steadily over the years and now comprises $9.6 trillion in investor assets globally.1 In the U.S., the ETF market is $6.4 trillion, just over one-quarter the size of the U.S. mutual fund market.2

ETFs are popular because they combine features of mutual funds and stocks, often at a low cost compared to similar mutual funds. Like a mutual fund, an ETF is a bundle of many securities that can be bought in one purchase. This usually provides the investor with the benefit of diversification, although the degree of diversification varies depending on how narrow or diverse are its holdings.

Like a stock, they are traded all day on an exchange and can be bought anytime during the day for their trading price at that moment. This distinguishes them from mutual funds, which can only be bought after the trading day ends, when their price for the day—the Net Asset Value, or NAV—is calculated. (You can place an order for a mutual fund during the day, but it won’t be executed until the end of trading.)

While many ETFs are designed to mimic an index, such as the S&P 500, they should not be confused with Index Funds. Index Funds are mutual funds that track an Index.

What types of ETFs are there?

Like stocks and mutual funds, ETFs come in all shapes and colors. Some track indexes and some don’t. Many are passively managed, but some are not. Some are highly diversified, but some aren’t. Many have relatively lower fees, but some don’t.

There are stock ETFs, bond ETFs, and ETFs for sectors, regions of the world, commodities, and various styles of investing.3 The most widely held ETFs are those that track an Index such as the S&P, the Dow, or the Russell 3000. (For example, the largest ETF is the SPDR S&P 500 ETF.)4 These index-tracking ETFs are popular because they are easy for investors to follow. If you hear that the S&P is up 2%, you can expect your S&P-tracking ETF to be up roughly the same amount.

Further, when ETFs track an index, they don’t require managers that make buy or sell decisions. This approach, called passive management, requires less human power, so it can be cheaper to operate, resulting in relatively lower fees to investors. Voila. Easy to understand, easy to manage, and relatively cheap…a triple attraction!

Some ETFs don’t track indices. Those non-tracking ETFs are actively managed, so the managers buy and sell holdings. They tend to have higher fees than passively managed ones. But the benefits of actively managed strategies potentially may make up for those higher fees. For example, passive strategies are designed to match—but not beat—the market performance, while active strategies strive to provide alpha—returns greater than the market. And research shows that funds don’t need hundreds of holdings to be diversified; holding just 20 securities could potentially provide the diversification benefits that help reduce non-market risk.5

How are they bought and sold?

When you place an order through a broker to buy or sell a mutual fund while the market is trading, the broker must wait until the market closes at the end of the day when the price is fixed to complete the trade directly with the mutual fund company.

In contrast, ETFs are traded on the exchange all day, and the market price can sometimes vary to a small degree from the NAV of the underlying assets. For example, if you want to buy ABC S&P500 ETF (ABC), go to your brokerage account and type in the symbol—ABC. Then you select how many shares and the price you want to pay. Hit submit and wait for your order to be filled! It’s no different from buying an individual stock.

How are they created and redeemed, traded, and taxed?

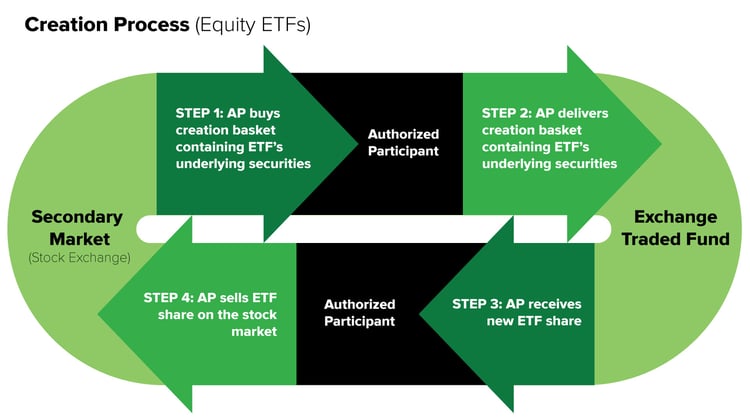

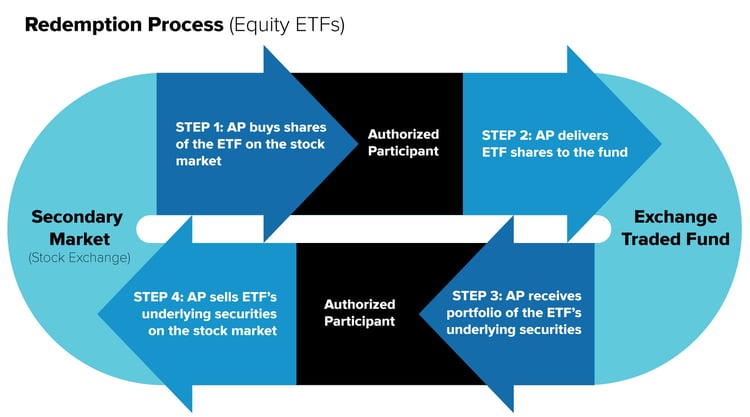

Three parties are involved with ETF transactions—the ETF issuer, the Authorized Participant (AP), and the investor. ETF investors—like you or your advisory client—buy or sell shares with other investors on an exchange in the secondary market. (This is the same process as trading a stock.) But behind the scenes, the ETF issuer and AP work together to create new units or redeem existing ones. It’s a confusing process that investors don’t see (just check out these two flow charts below!). But it’s important for one reason: tax efficiency.

Source: ETF.com

Source: ETF.com

Generally, ETFs can be more tax efficient than mutual funds for two reasons.

First, because ETFs sell between investors on a public exchange, like the New York Stock Exchange, the underlying securities are not changed with this transaction. So while investors who sell their shares may produce capital gains for themselves, this transaction does not affect the rest of the ETF’s investors.

Second, an issuer needs to sell an underlying security only in very few instances. For example, when the tracking index rebalances, then a passive fund may need to sell securities to follow the target index. Or when the issuer makes a change to a holding, then the fund needs to follow suit.

This differs for mutual funds. Not only are capital gains raised when passive funds need to rebalance alongside the index and active ones need to sell securities they no longer feel compelled to hold every time a fundholder decides to sell their slice of the fund, but capital gains are also generated. For example, if Donna sells her 1% stake in fund ABC, then ABC will need to sell all their securities in the right percentage to make up 1% of the fund to payout Donna’s investment. This extra selling makes mutual funds less tax efficient than ETFs for current investors.

What’s the value of the ETF?

Mutual funds do not trade intraday. Instead, all transactions occur after the market closes, and the fund is priced at 4:00 ET every day. The value of the fund is expressed by the net asset value (NAV). ETFs also calculate a NAV. NAV is the total value of all the cash and securities in a fund’s portfolio minus any liabilities (like expenses) divided by the number of shares outstanding.

But since ETFs trade throughout the day, they also have a market price which is the price at which investors can buy or sell an ETF on an exchange. This price may deviate from the NAV depending on supply and demand for the ETF.

Do ETFs always have lower fees?

Yes, generally, many do. ETFs have a simple unitary fee-based structure. That’s it.

Mutual funds fees are more complex and layered and can differ by share class (institutional vs. retail investor). There are two types of fees—shareholder fees and operating expenses—that, when added up, can significantly eat into a fundholder’s return.

Shareholder Fees

- Sales Loads—similar to the commission you pay to a broker

- Redemption Fee—imposed when you redeem your shares in the fund

- Exchange Fee—imposed when exchanging fund shares for the shares of another fund within the same fund group

- Account Fee—imposed if an account falls below a certain level

- Purchase Fee—some funds charge this fee when you purchase their shares

Annual Fund Operating Expenses

- Management Fees—paid out of fund assets to the fund’s investment advisor

- Distribution (12b-1) Fees—paid out of fund assets to cover distribution expenses

- Other Expenses—examples include legal and accounting costs

- Total Annual Fund Operating Expenses—expressed as a percentage of the fund’s average net assets

Source: SEC

What other unique features do ETFs have?

If transparency is important to you, you’ll probably favor ETFs. Unlike mutual funds, ETFs are required to reveal their holdings and weightings daily. On the other hand, most mutual funds only reveal their holdings quarterly. 6

Another difference from mutual funds is that you can buy ETFs on margin and sell them short. Neither is allowed with mutual funds. 7 This, along with intraday pricing, is reasonably why active traders favor ETFs over mutual funds.

Five characteristics make ETFs appealing

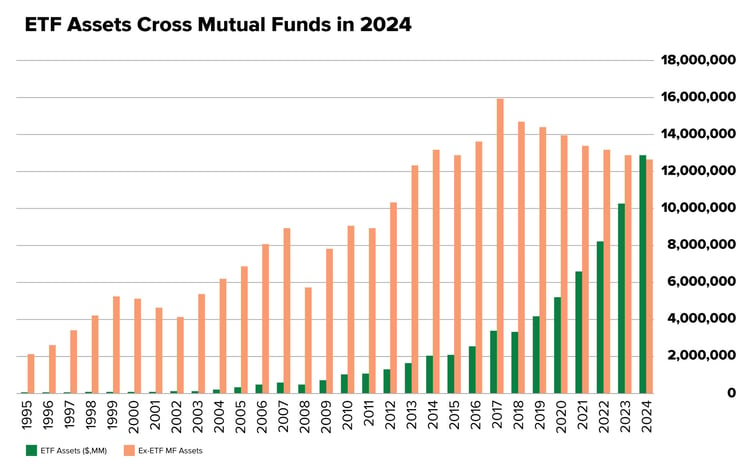

Mutual funds have been around much longer and still comprise a larger market share than ETFs. But the ETF market is growing fast. In fact, mutual fund growth peaked in 2017 and has been declining while ETFs have been growing. The reasons for ETFs’ popularity are simple: Five characteristics—relatively lower fees, intraday trading, tax efficiency, simplicity, and transparency—are increasing their appeal.

Source: ETF.com, Investment Company Institute, Factset, Dec. 10, 2019

Source: ETF.com, Investment Company Institute, Factset, Dec. 10, 2019

1Statista.com, data through 2022, accessed Jul. 28, 2023

2Statista.com, data through 2022, accessed Jul. 28, 2023

3Blackrock.com, July 17, 2022

4Statista.com, June 7, 2022

5Elton, Edwin. Gruber, Martin. “Risk reduction and portfolio size: An analytical approach.” The Journal of Business, Oct. 1977.

6Investopedia, Apr 5, 2022. There are some semi-transparent ETFs that do not disclose their holdings daily.

7Finra.org, July 20, 2022

Related Posts

All That Glitters

McFaddin on the Markets

Now that the first month is behind us, and we have 11 more to keep us busy, I think now is as good...

What is a Bond Ladder?

A bond ladder is a fixed income strategy that involves owning a series of individual bonds with...

Looking Beyond the 60/40 Portfolio

The 60/40 portfolio, consisting of 60% stocks and 40% bonds, has long been the standard balanced...

Interested in more?

Get our popular newseltter delivered to your inbox every month.

Search the Insights Blog

How to invest with us

Click the button below to learn how you can get started with Motley Fool Asset Management