Do you know the difference between exchange-traded funds (ETFs) and mutual funds? At first glance, ETFs and mutual funds may seem like very similar investment vehicles. But there are some key differences between these two types of financial products that can potentially have a major impact on your investments. Here’s a look at the three “T”s that distinguish ETFs from mutual funds that we believe make ETFs a more attractive option.

What are mutual funds and ETFs?

Mutual funds and ETFs are both investment vehicles made up of a pool of money from many different investors. The money in the fund is then used to buy stocks, bonds, or other investments. Both offer easy access to a wide range of investments in one convenient package. They also generally provide instant diversification and access to portfolios that can support a variety of investment strategies.

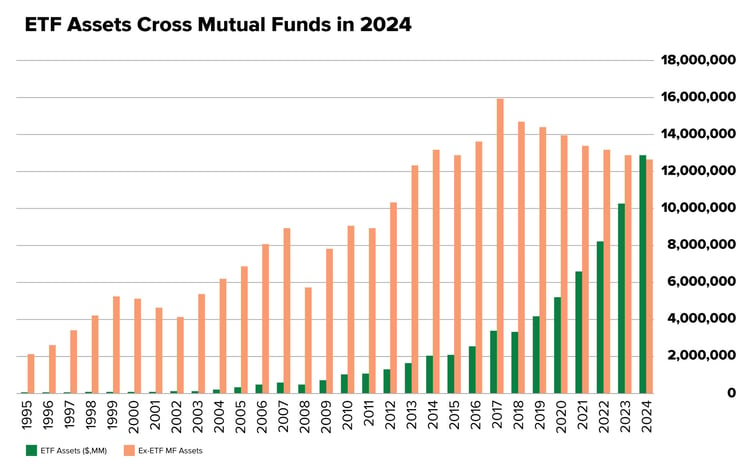

Mutual funds have been around a lot longer than ETFs. Thus, they account for significantly more invested assets. Globally, as of November 2022, there are currently 131,808 mutual funds1 with close to $60 trillion in assets.2 While mutual funds have been around for close to 100 years, the first U.S. ETF was created in 1993.3 Ten years after their creation, there were 276 ETFs. As of 2021, there are now 8,552 ETFs globally with more than $10 trillion in assets.4 ETFs are one of the fastest-growing financial products, especially popular among institutional investors, like pension plans, as 78% use ETFs as their go-to index investment.5 With this explosive growth, ETFs are expected to amass the same level of assets as mutual funds in the next few years.6

Source: ETF.com, Investment Company Institute, Factset, Dec. 10, 2019

Source: ETF.com, Investment Company Institute, Factset, Dec. 10, 2019

What’s the appeal of ETFs? These three “T”s are just some of the reasons why ETFs have become popular.

1. Transparency

Investors have turned to ETFs to get more transparency in their portfolios. Unlike mutual funds, which can be difficult for some to understand and evaluate, ETFs provide investors with detailed information on the underlying securities that make up the fund.

Mutual fund managers only have to disclose their holdings 60 days after the end of a quarter. ETFs, however, disclose their holdings daily.7 This daily ETF information helps investors understand a fund’s exposure to different geographies, sectors, industries, and individual stocks. The saying goes that knowledge is power, and by having daily insight into how their investment dollars are allocated, we believe generally, ETF investors can potentially make more informed decisions compared to mutual fund investors about their overall portfolio.

However, not all ETFs are created equal. Unlike managers of fully transparent ETFs, some managers may not want to openly share their trades and investment strategies. So, the Securities and Exchange Commission (SEC) approved "semi-transparent" ETFs, which do not require disclosure of portfolio holdings on a daily basis.8 These opaque funds can be attractive to many managers who want to take advantage of ETFs' popularity but are not beholden to reveal their "secret sauce.” Like mutual funds, they only need to disclose holdings quarterly.

2. Tax efficiency

Generally, ETFs tend to be more tax-efficient than mutual funds due to their unique structure. When a mutual fund needs to free up cash due to investor redemptions, it has to sell its underlying securities. As a result, mutual funds tend to generate more capital gains. So even if investors have not sold any of their own shares, they will be taxed on the capital gains the mutual fund generates.

The ETF’s process is different. First, since ETFs trade over an exchange, they typically buy and sell with other investors. Therefore, shares are rarely redeemed. But if they need to raise extra capital to give to investors, ETFs can leverage an in-kind redemption process. This means that ETFs typically don't have to sell underlying securities when a large number of investors are selling, making ETFs generally more tax-efficient.

Another major difference between ETFs and mutual funds is the turnover rate. The majority of ETFs are passively managed, while many mutual funds are actively managed. Because passive ETFs trade infrequently, in general, they tend to be more tax-friendly due to producing fewer turnover events, thereby potentially decreasing the number of occurrences for capital gains distributions. By contrast, active mutual funds generally often have higher turnover rates than ETFs, meaning that their underlying investments are frequently bought and sold throughout the year. With that said, not all active mutual funds, or actively managed ETFs, for that matter, have high turnover. And overall, those mutual funds and ETFs that have low turnover tend to be more tax-efficient than high-turnover ones.

3. Trading flexibility

ETFs offer more trading flexibility than mutual funds. As we mentioned, ETFs trade on exchanges. Mutual funds do not. So just like stocks, you can buy or sell ETFs throughout the day and know precisely the value of your investment at any point in time. Mutual funds, however, can only be bought or sold and thus are valued (or priced) once a day at market close (4 p.m. ET).

This generally makes ETFs much more liquid than mutual funds, which we believe can be a big advantage for investors. What do we mean by liquid? Generally, investors who want to take advantage of market fluctuations or who need to sell their shares for emergency purposes can do so without delay. But with mutual funds, they need to wait until the end of the market day.

Investors in ETFs can have flexibility in when they can buy and sell shares and at a what price. ETF investors can also use advanced trading techniques such as limit orders, short-selling, and margin trading.

ETFs also do not require a minimum investment amount. So like stocks, the minimum investment for an ETF is typically a single or fractional share. Mutual funds generally can have minimum investment amounts, typically ranging from $500 to $10,000, with some even higher.

Summing it up

While both ETFs and mutual funds are popular pooled investment vehicles, they differ in important ways. We believe ETFs offer some distinct advantages over mutual funds—the three “T”s. If you’re looking for a more transparent, tax-efficient, and flexible investment option, an ETF may be right for you. With their many advantages and flexibility, we consider ETFs generally the better choice for many investors seeking to take advantage of market opportunities and minimize potential taxes.

Footnotes

1Total number of worldwide regulated open-end funds from 2007 to 2021, Statista, accessed Nov. 10, 2022

2Worldwide Regulated Open-End Fund Assets and Flows Second Quarter 2022, ICI, accessed Nov. 10, 2022

3Visualizing the Expanse of the ETF Universe, Blackrock, accessed Nov. 10, 2022

4Number of exchange traded funds (ETFs) worldwide from 2003 to 2021, Statista, accessed Nov. 10, 2022

5The 26-Year History of ETFs, in One Infographic, Visualcapitalist, Jan. 21, 2020.

6ETF.com, Investment Company Institute, Factset, Dec. 10, 2019

7Semi-transparent ETFs do not disclose daily holdings

8What are semi-transparent ETFs? JP Morgan, May 15, 2020

Related Posts

Market Predictions are Futile

Mann on the Street

A few years ago I got to hear JPMorgan CEO Jamie Dimon give a talk at a conference in Hong Kong,...

The Hidden Cost of Chasing Trends

Identifying a major investment trend before it hits the mainstream feels like finding buried...

How Can ETFs Help Investors Avoid The Wash Sale Rule?

Selling an investment at a loss can be smart tax planning—but only if you don’t accidentally give...

Interested in more?

Get our popular newseltter delivered to your inbox every month.

Search the Insights Blog

How to invest with us

Click the button below to learn how you can get started with Motley Fool Asset Management