The U.S. dollar is flexing its muscles. So far this year, the U.S. Dollar Index, which tracks the dollar against six other currencies, has gained 15% and is near a 20-year high.1 So, is a strengthening dollar a good thing for your wealth?

The concept of a strong dollar is hard to understand. One reason is that it’s not an individual currency phenomenon. Instead, it’s more like a tug-of-war: If the dollar strengthens, another currency—like the euro or Yen—must weaken.

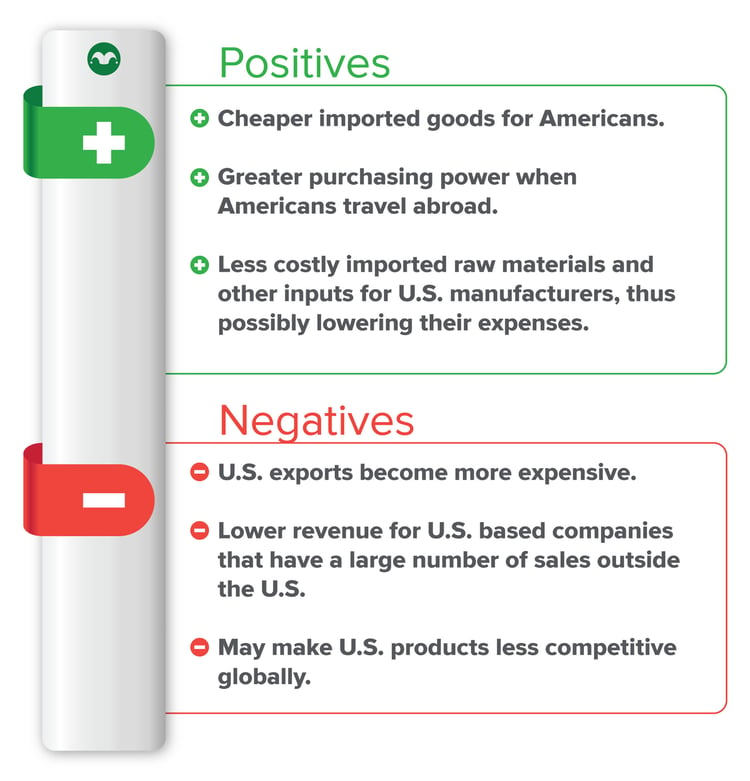

Another reason is that a strengthening dollar is not good or bad. It depends on your perspective. What does that mean? Of course, the answer is not straightforward (shocking—what part of economics is?). But all else being equal, this chart can help explain some of the potential positives and negatives.

So, a strengthening dollar is a double-edged sword—it may give you access to cheaper foreign goods and the ability to buy more for less when you travel overseas. But, it could hurt America’s competitiveness, which may ultimately decrease U.S. economic growth.

So, a strengthening dollar is a double-edged sword—it may give you access to cheaper foreign goods and the ability to buy more for less when you travel overseas. But, it could hurt America’s competitiveness, which may ultimately decrease U.S. economic growth.

How could rising rates impact the dollar strength?

Investors, especially foreign governments, need to put their money somewhere. So, they usually invest in what they believe to be the safest, highest-yielding instruments available. Often, that has been U.S. government bonds.

Rising rates in the U.S. usually mean treasury bonds offer higher yields. So, foreigners may buy U.S. bonds (in dollars) which may continue to strengthen the U.S. dollar.

Footnote

1U.S. Dollar Index (DXY), Oct 26, 2022.

Related Posts

Market Predictions are Futile

Mann on the Street

A few years ago I got to hear JPMorgan CEO Jamie Dimon give a talk at a conference in Hong Kong,...

The Hidden Cost of Chasing Trends

Identifying a major investment trend before it hits the mainstream feels like finding buried...

How Can ETFs Help Investors Avoid The Wash Sale Rule?

Selling an investment at a loss can be smart tax planning—but only if you don’t accidentally give...

Interested in more?

Get our popular newseltter delivered to your inbox every month.

Search the Insights Blog

How to invest with us

Click the button below to learn how you can get started with Motley Fool Asset Management