Do you have mid-cap stocks in your portfolio? Maybe you don’t know because there isn’t a uniform definition of a U.S. mid-cap stock. Some experts say a mid-cap is any U.S.-based company with a market capitalization greater than $2 billion and less than $10 billion. Others use a somewhat higher range, such as $5 billion to $20 billion.

So, that's a general idea of what a mid-cap stock is. But the more important question is: Why should investors choose to add mid-cap stocks to their portfolio?

How can you identify a mid-cap stock?

Many investors look to the benchmark to see what falls in the mid-cap universe. The most widely used benchmark is the S&P MidCap 400, which includes 400 U.S. mid-sized companies. Rather than using set-in-stone thresholds for market cap, the index is designed to fit between the S&P 500 large-cap index and the S&P SmallCap 600. As of Sept. 30, 2022, the S&P MidCap 400 index included companies with market capitalizations ranging from $3.7 billion to $14.6 billion.1

There are other mid-cap indices as well, and most have their own (slightly different) definition of a mid-cap stock. For example, the Russell Midcap Index contains 800 stocks, with a somewhat wider range of market caps. The median market cap in the Russell Midcap index is about $8.8 billion, while companies as large as $46.8 billion are included in this broader basket of mid-sized companies.2

Why invest in mid-cap stocks?

The argument behind investing in mid-cap stocks is that they combine some of the most favorable attributes of both small and large businesses. For example, mid-cap stocks are often relatively early in capturing their full market opportunity while successfully navigating their early growth phase. They may tend to have less volatility than small-cap stocks due to their somewhat higher level of maturity, without being so large that long-term growth potential is limited.3

In short, mid-cap stocks can potentially offer a favorable balance of risk and return that can be lacking in large- or small-cap stocks.

This combination of high growth potential and relatively low volatility makes mid-cap stocks an excellent place to invest. In fact, since 1994, U.S. mid-caps have outperformed both U.S. large-cap and U.S. small-cap stocks more than half of the time, according to FactSet data through the end of 2021.4

Mid-cap stocks in rising rate environments

The current stock market environment is challenging, so let’s look at how mid-cap stocks have performed in similar environments, starting with rising rates. The Federal Reserve aggressively raised the benchmark federal funds rate in 2022, and many experts believe there are more rate hikes to come.5

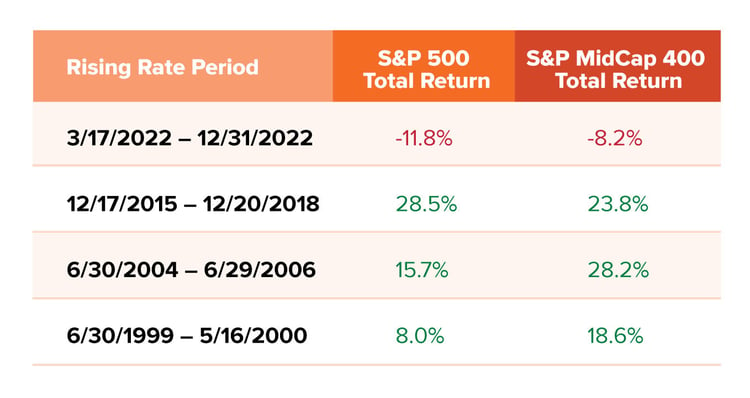

Over the past 25 years, there have been four sustained periods of Federal Reserve rate hikes,6 including the current one. During those periods, how have mid-caps performed?

Data source: YCharts. Dates represent each cycle's first and last Federal Reserve interest rate increase.

Data source: YCharts. Dates represent each cycle's first and last Federal Reserve interest rate increase.

The data show mid-caps have slightly outperformed the S&P 500 so far in the current rate-hike cycle. In fact, that seems to have been the case most of the time—the S&P MidCap 400 outperformed its large-cap counterpart (S&P 500) in two of the three other recent rate-hike cycles, too.

Mid-cap stocks in recessions

It’s also important to point out that the current rate-hike cycle has characteristics that differ from the other three. Specifically, the other rate hike cycles mentioned occurred while the stock market was generally strong—the first was during the dot-com boom, the second was during the housing bubble leading up to the Great Recession, and the last was during the long bull market that didn’t end until the COVID-19 pandemic.

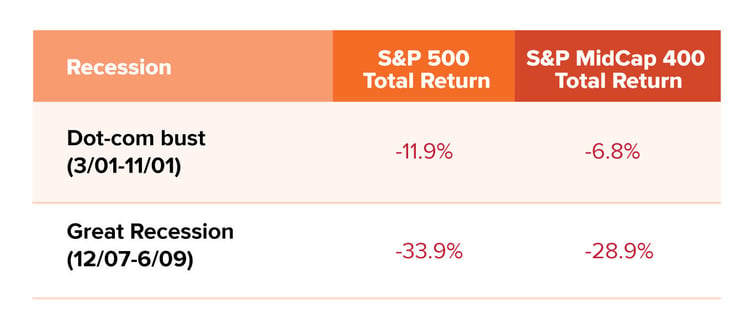

With that in mind, it’s also wise to look at how mid-caps perform during tough times. And while we’re not officially in a recession, many experts predict one soon. There have only been two official recessions in the past 25 years, excluding the short-lived recession at the start of the COVID-19 pandemic, and both followed shortly after a rate-hike cycle.

Data source: YCharts

Data source: YCharts

It’s a common perception among investors that large-cap companies tend to hold up best during turbulent times. And to be fair, this is often true when compared to small-cap stocks. But as you can clearly see above, mid-caps have significantly outperformed the S&P 500 during both recessions in the past 25 years.

Putting it all together

There’s no way to know for sure how well mid-cap stocks will do over the next year or so. Every rate-hike cycle and recession are different, so although mid-caps certainly have a solid track record, there’s no guarantee that they’ll outperform in today’s environment. All investing involves risk and may lose money, including principal.

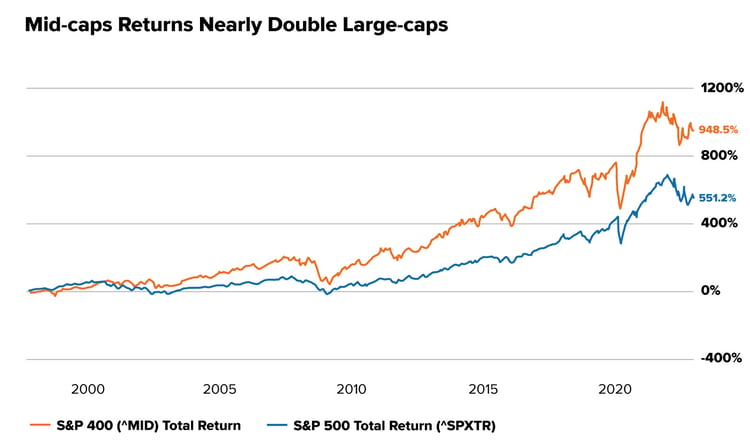

Having said that, we’ll end with the performance of mid-cap stocks over time. We’ve used the rate-hike environments of the past 25 years and the recessions during the same period, but what about the past 25 years as a whole?

Well, over the past quarter century, the S&P MidCap 400 index has outperformed the S&P 500 by an impressive 398%—949% to 551%.7

Source: YCharts. Data is from Oct. 25, 1997 through Dec. 31, 2022

Source: YCharts. Data is from Oct. 25, 1997 through Dec. 31, 2022

So, while we cannot forecast what may happen in the future through similar tough economic environments, and over the long term with many market cycles in the past, U.S. mid-caps have historically outperformed their large peers.

Footnotes

1S&P MidCap 400 Index Fact Sheet, through Sep. 30, 2022

2Russell Midcap Index Fact sheet, as of Sep. 30, 2022

3The Motley Fool, Oct. 20, 2022

4ssga.com, as of Dec. 31, 2021

5CMEgroup.com FedWatch Tool, Oct. 24, 2022

6Forbes, Sep. 21, 2022

7Source: YCharts. Data is from Oct. 25, 1997 through Dec. 31, 2022

Related Posts

Market Predictions are Futile

Mann on the Street

A few years ago I got to hear JPMorgan CEO Jamie Dimon give a talk at a conference in Hong Kong,...

The Hidden Cost of Chasing Trends

Identifying a major investment trend before it hits the mainstream feels like finding buried...

How Can ETFs Help Investors Avoid The Wash Sale Rule?

Selling an investment at a loss can be smart tax planning—but only if you don’t accidentally give...

Interested in more?

Get our popular newseltter delivered to your inbox every month.

Search the Insights Blog

How to invest with us

Click the button below to learn how you can get started with Motley Fool Asset Management