Have you ever played the game two truths and a lie? It’s a game where someone gives you three statements, and you have to figure out which one is false. We’re going to play our version right now:

Statement 1: The stock price of many global leaders has fallen a lot this year.

Statement 2: A company’s value diminishes in tandem with its stock price.

Statement 3: Many investors have lost faith in the companies they once believed were true market leaders.

Can you guess which is the lie? Yup, you got it—Statement 2 is false. Before we dive into why let’s explain the two truths.

Truth: The stock price of many global leaders has fallen a lot this year.

True. With 2022 nearly over, the S&P 500 is down roughly 14% from its high on Jan. 3, 2022.1 While that is difficult to swallow, the news is even worse if you look under the hood. At some point this year, nearly half of the companies in the index were down more than the index, and 138 of the 500 companies were significantly worse, down at least 30%.2

Truth: Many investors have lost faith in the companies they once believed were true market leaders.

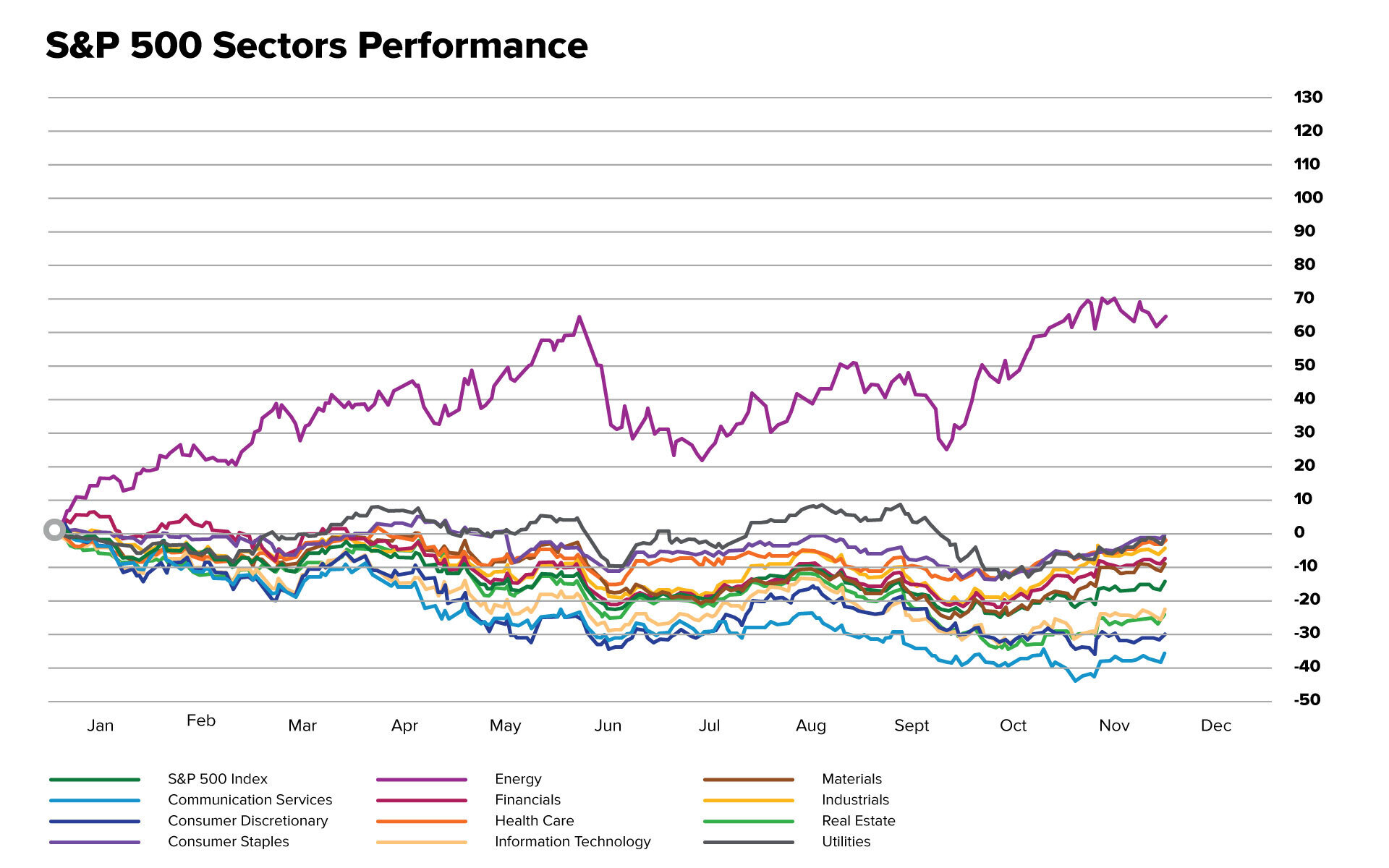

The broad-based nature of the recent sell-off tells us that many investors have lost faith in true market leaders. Even though many companies have declined more than the indices, the overall fall of the entire market says that these investors are "throwing the baby out with the bath water." Every sector except energy is down this year, and many have declined double-digits.

Source: Standard & Poor’s, data through Nov. 30, 2022.

Lie: A company’s value diminishes in tandem with its stock price.

Many investors confuse stock price and company value. The stock price reflects a company’s fundamentals—such as sales growth, margin expansion, increasing cash flows, or earnings growth. But it also mirrors sentiment—which usually shows itself in the valuation multiple assigned to a stock. More optimistic investors may bestow a higher valuation multiple because they believe future growth will be robust. But pessimistic investors give companies lower multiples. This pessimism or optimism can mirror the individual company’s prospects or the entire market’s expected growth.

Today, sentiment surveys indicate that consumers and businesses are highly pessimistic. For instance, the latest reading of small business is the 10th consecutive month below the 49 -year average of 98. Even worse, expectations of better business conditions over the next six months continue to fall.3 Similarly, consumer sentiment continued its downward trend that began last year and reached its lowest recorded value, comparable to the 1980s low recessionary level.4

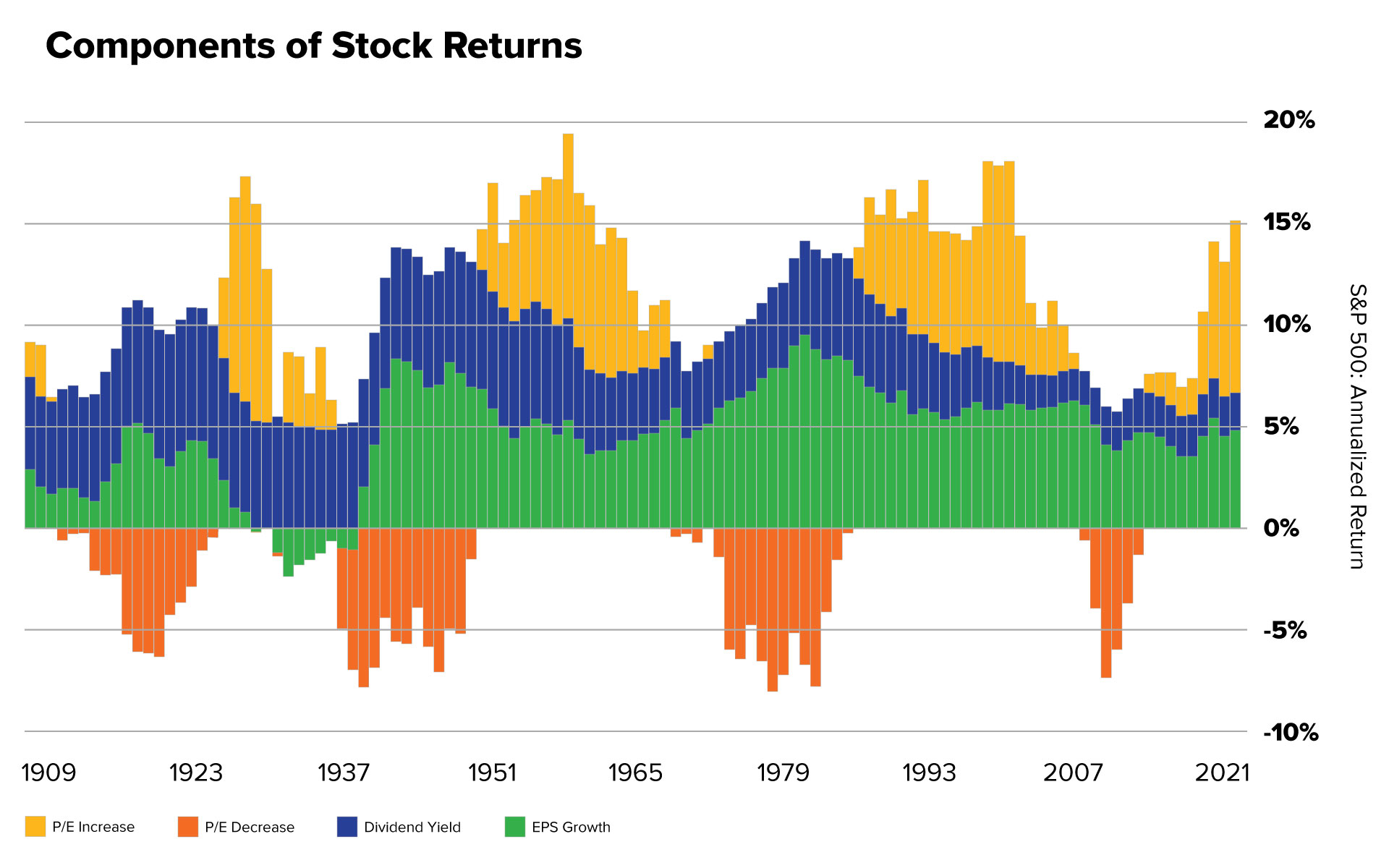

Understanding how sentiment and fundamentals influence a stock’s price vs. a company’s value is essential. Three main components comprise shareholder returns. Two parts are financial fundamentals—earnings growth (blue bars) and dividends (brown bars)—and one part is sentiment—valuation multiples (green and red bars). You can see that dividends have been relatively stable since the mid-90s, averaging roughly 2% per year. In contrast, earnings growth and valuation multiples have significantly varied over time, although valuation multiples are the most volatile.

Source: Crestmont Research, Data through Dec. 31, 2021

So what does this mean for investors?

When the market multiple contracts/expands, it is generally a function of sentiment rather than fundamentals. That is what has happened this year. At the high of the market on Jan. 3, 2022, the forward P/E for the S&P 500 hit 21.4x.5 Since then, it has fallen to 17.7x.6

That’s not to say that sometimes this contraction isn’t warranted. Of course, some companies never deserved their elevated multiples because they did not have sustainable business models. But even strong companies may experience multiple contractions. Some may have gotten caught in a euphoric fray, and their multiples may have grown ahead of their fundamentals. Others may have deteriorated along with economic conditions that could impact a company’s short-term prospects and result in lower earnings. So sometimes, contracting multiples may make sense for that short period.

But as long-term investors, we don’t get caught in the web of near-term sentiment. Instead, we believe that Quality companies with solid fundamentals should continue along a general growth trajectory, even if they hit a temporary speed bump due to the economy. That’s because we think these companies’ products and services should create value for their customers.

That’s why stock prices do not always reflect a company’s value.

Just because consumers or businesses feel low doesn’t mean a company has necessarily lost its value. It just may mean its stock price has taken a temporary hit. And while it may be painful to take those blows, they also could provide an opportunity to buy Quality companies at sale-fire prices.

So what do we do? We buy what we believe to be long-term winners through these types of sentiment storms and fight back against those pesky emotions!

Footnotes

1Jan. 3, 2022 through Dec. 1, 2022

2S&P Capital IQ, as of Nov. 30, 2022

3nfib.com, Oct. 2022

4sca.isr.umich.edu, preliminary results for June 2022

5Factset, May 16, 2022.

6Yardeni Associates. Nov. 30, 2022

Related Posts

Market Predictions are Futile

Mann on the Street

A few years ago I got to hear JPMorgan CEO Jamie Dimon give a talk at a conference in Hong Kong,...

The Hidden Cost of Chasing Trends

Identifying a major investment trend before it hits the mainstream feels like finding buried...

How Can ETFs Help Investors Avoid The Wash Sale Rule?

Selling an investment at a loss can be smart tax planning—but only if you don’t accidentally give...

Interested in more?

Get our popular newseltter delivered to your inbox every month.

Search the Insights Blog

How to invest with us

Click the button below to learn how you can get started with Motley Fool Asset Management