When I was in college, one of the things that drew me to economics and mathematics was the nature of questions and answers. Numbers don’t have opinions. Even when the answer was a multi-figure set or "no solution," there was still only one outcome. Even science, never my strongest subject, made sense to me because of the three laws of motion: Inertia, acceleration, and reaction.

Human behavior, on the other hand, couldn’t be more different. I only started to appreciate that nuance once I grew in my investment career, where the clean rules of math and economics met the messy reality of people.

Since we humans are anything but rational on our best days, I’d say we operate on a continuous rather than discrete spectrum of action and reaction. So then, what are the driving forces in the market, this place where continuous human irrationality and the discrete finality of data meet? Let’s discuss.

What are the fundamentals?

For the sake of this discussion, let’s define fundamentals as the set of quantitative and qualitative data used to determine a company’s intrinsic value. This set varies across strategies, analyst preferences, and many other factors, but the bulk come from familiar places: Income statement, balance sheet, cash flow statement, and other official filings.

A few staples in my work have been revenue growth, gross- and operating-margins, free cash flow analysis, interest coverage, net debt, and return on invested capital. I regularly use these metrics alongside things like management sentiment, peer comps, and industry data to form the basis of my cash flow models for valuation. These, among others, are my "ole faithfuls"; they can be assessed regularly and are unique to each company.

In the past, companies moved based on the forces exerted by their fundamentals. In other words, high performance and rewarding valuations weren’t limited to one industry—they varied according to what each company delivered period over period. Things aren’t quite the same in the here-and-now.

Gasping for breadth

Today’s markets suffer from a lack of breadth when it comes to performance. A tremendous amount of gains and outperformance are concentrated amongst a few companies rather than distributed across the index.

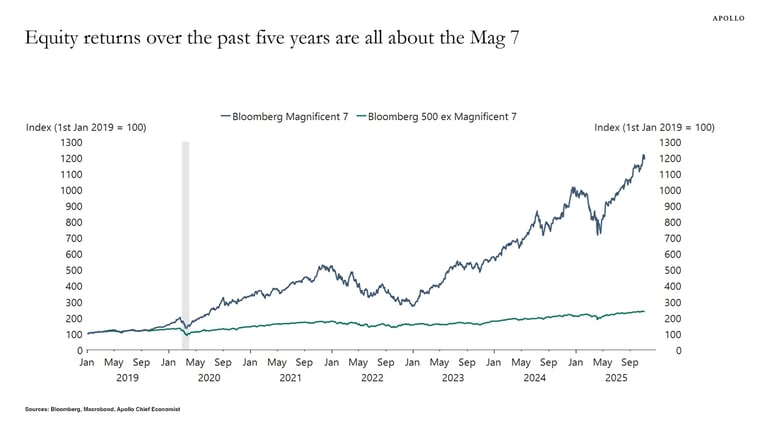

That’s not to say "the rest" haven’t delivered handily over the last five years, but the blow out performance is limited to the Magnificent 7 (Figure 1). One side effect of this concentration has been the herd-like behavior across the remainder of the market. Stocks move (or don't move) more like tidal waves than a race of raindrops, where each droplet is a little different from the next.

At the same time, outside of this tech-driven group, it appears to me many large cap companies are starting to trade on "fundamentals" that are more akin to externalities, sometimes completely disconnected from their earnings reports.

So, what happened? Did everything just fall apart between the top and bottom line? Was there some event none of us heard about that only impacted the S&P 493? Thankfully, I believe the answer to both is no. This means that something else is moving—or rather thwarting—even the best of the rest in the broad market.

Redefining gravity?

There are some (not so) new forces that have more power now than in the past. Today, I’m calling these The New Fundamentals, and they include but aren’t limited to: The Fed and all their chatter, any morsel of news out of a Mag 7 company, and good old Uncle Sam.

As of late, it appears interest rates have largely told the story of the gap between small and large caps. The mega cap tech leaders seemingly hold the market in their hands as it hangs onto every word around AI-related capital expenditure. To top it off, the global trade environment remains volatile, leaving companies and analysts alike to make educated guesses about what’s coming in future quarters.

These new laws of motion both pose a challenge to, and create an opportunity for, an active investor. While I’m up against a rejection of factors that were valuable in the past, I’m also armed with an arsenal of truths, supported by financials, that allow me to act when my favorites are misunderstood—and I believe they’ll correct over the long term. That’s what keeps me optimistic and excited about this market, even with so much change in such a short time.

I hope you’re still as excited to find opportunities as I am!

Until next time,

Shelby

Related Posts

Market Predictions are Futile

Mann on the Street

A few years ago I got to hear JPMorgan CEO Jamie Dimon give a talk at a conference in Hong Kong,...

The Hidden Cost of Chasing Trends

Identifying a major investment trend before it hits the mainstream feels like finding buried...

How Can ETFs Help Investors Avoid The Wash Sale Rule?

Selling an investment at a loss can be smart tax planning—but only if you don’t accidentally give...

Interested in more?

Get our popular newseltter delivered to your inbox every month.

Search the Insights Blog

How to invest with us

Click the button below to learn how you can get started with Motley Fool Asset Management