Everyone's looking for the sure thing. Investors are no different. Unfortunately, there are very few things in life that are sureties. (Well, maybe if you were a Buffalo Bills fan in the early 1990s, making it to the Super Bowl…and losing felt like it was written in stone! Sorry Bills Mafia 💔) However, life offers no guarantees, especially in investing. That’s why investors seek signs or signals that may point to positive stock returns.

Unfortunately, there are a crazy number of metrics investors can use to value a company and try to predict returns. For example, many use a market multiple—like price-to-earnings (P/E). Others may add growth to that measure to arrive at a price-to-earnings divided by earnings growth (PEG) ratio. Still, more investors may compare dividend yields or free cash flow yields. And the list goes on…and on.

How do you measure profitability?

[WARNING: We’re doing some accounting and financial analysis here!]

But which measure of profitability? There’s the bottom line, otherwise known as net income. There is also operating income and earnings before interest, taxes, depreciation and amortization (EBITDA), and iterations on each. Some of the differences lie in the nuances of accounting rules, particularly around allowable non-cash deductions that fall on the income statement or give discretion to the company on what to include. And they may include accounting adjustments that can be “massaged” to an extent. These adjustments can distort true earnings, so many analysts "un-adjust" these adjustments. Messy? You bet.

Instead, some investors use a more straightforward metric, gross profit. Calculated as revenue minus expenses incurred by making the goods sold, we consider it a purer measure because it includes fewer adjustments or other costs that may lower income and are more at management’s discretion.

More importantly, research backs gross profits as a forecaster of stock returns. Data has shown that “more profitable companies today tend to be more profitable companies tomorrow. Although it gets reflected in their future stock prices, the market systematically underestimates this today, making their shares a relative bargain—diamonds in the rough.”1

Profitability is a robust measure. But it doesn’t tell you how well a company uses its capital and resources to generate that income. So how do you know if a company wastes resources and fails to generate adequate profits? In other words, if two companies have the same profits but one takes ten times more capital to generate that profit, should they be valued the same?

And that brings us to our second metric: Capital efficiency

Capital efficiency describes how effectively a company spends its money to operate and grow the business. Precisely, capital efficiency measures how much capital is put into the business (its investments) and how much profitability it produces from those investments.

It's like when considering putting a pool in your backyard. Before giving the go-ahead, many homeowners ask: Will this pool make my house more valuable? (Or in investment speak: Will I get a return on that investment (via a higher selling price) when I sell my home?) If the pool lowers your home's value, it’s an inefficient use of money. But if it increases your home’s price, then that’s good. And if it increases it by at least the amount you spent to install the pool—and perhaps even more—that’s high capital efficiency. The result: The asset (pool) generates a return (higher selling price).

Of course, there are numerous ways to measure capital efficiency. Return on capital is a common one. But return ratios (like return on capital) measure profitability with net income, which can be manipulated by accounting adjustments, as we mentioned above.

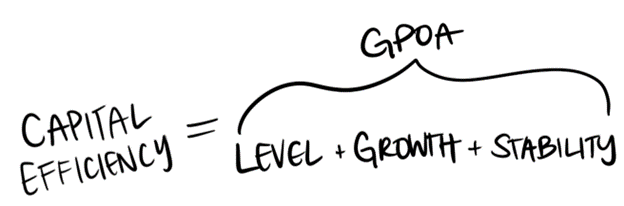

Another variation is gross profit over assets (GPOA). We’ve already discussed how we feel gross profit offers a purer measure of profitability. And by dividing earnings by assets, investors can get a sense of how well assets drive profits.

But does gross profit over assets paint a complete picture?

While GPOA is a robust measure, it fails to account for other necessary expenses like most employee compensation, research and development (R&D), and marketing. And by using assets, investors are not capturing a company’s debt.

To account for these drawbacks, we think it's important to look at the level of capital efficiency together with its growth and stability.

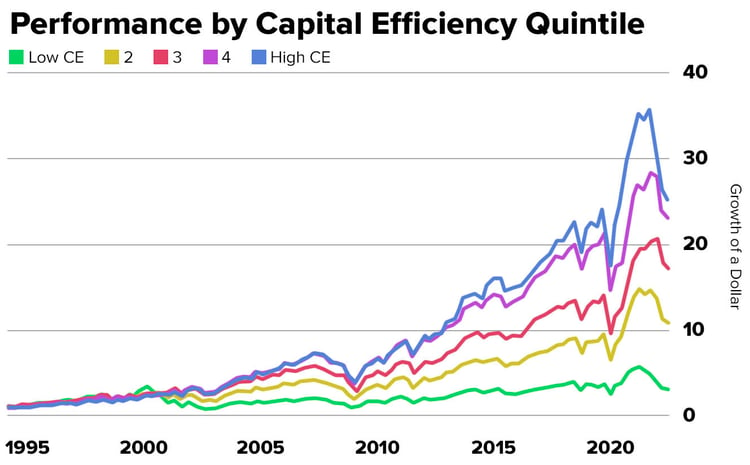

Capital efficiency tends to grow if a company effectively uses its R&D and marketing spend. Likewise, more stable companies can use financial leverage (debt) and return more to shareholders. Both growth and stability of capital efficiency add robustness and reliability and can signal the health of a business more clearly. For example, three decades of data show that stocks with high levels and growth of GPOA have outperformed stocks with low levels and growth by over 12% annually.2

This chart shows the growth of a dollar invested for five quintiles of companies segmented by GPOA. The highest capital-efficient quintile outperformed all others over the nearly 30-year period.

Source: S&P Capital IQ, Calculations by The Motley Fool, LLC. Chart shows the capital efficiency across ~3000 stocks each day. Capital efficiency is measured by GPOA. Data from March 1994 through March 2022.

Source: S&P Capital IQ, Calculations by The Motley Fool, LLC. Chart shows the capital efficiency across ~3000 stocks each day. Capital efficiency is measured by GPOA. Data from March 1994 through March 2022.

Capital efficiency as a sign of stock returns…even in today’s market

We believe companies with high capital efficiency generate stable profitability and growth over time. The reason? Capital efficiency is a robust signal of a company’s fundamental health—from how well the management team can execute its strategy and deliver competitive advantages to solid economics and the potential for a positive growth trajectory. Healthy companies, we believe, can provide outsized long-term return potential. Notice how we said “long term.” Because in the short term, volatility may outweigh fundamentals and create some randomness in returns. All investments involve risks and may lose money, including principal. But we believe if we buy and hold, fundamentals can persevere, and market-specific factors that sometimes affect returns in the here and now can dissipate over time.

But recently, investors have been seeking the perceived safety of value over growth stocks. So how does capital efficiency fit into this picture? Data show that “gross profitability factors generated value-like excess returns, even though they were growth strategies.”3

So growth and value…long and short term—capital efficiency appears to be a well-rounded, all-weather predictor of stock returns.

Footnotes

1sciencedirect.com, Jul. 2019

2spglobal.com, June 2018. Data from January 1988 – February 2018. Capital efficiency is measured by GPOA

3Novy-Marx, R., (2013) “The Other Side of Value: The Gross Profitability Premium” Jun. 2012

Related Posts

Market Predictions are Futile

Mann on the Street

A few years ago I got to hear JPMorgan CEO Jamie Dimon give a talk at a conference in Hong Kong,...

The Hidden Cost of Chasing Trends

Identifying a major investment trend before it hits the mainstream feels like finding buried...

How Can ETFs Help Investors Avoid The Wash Sale Rule?

Selling an investment at a loss can be smart tax planning—but only if you don’t accidentally give...

Interested in more?

Get our popular newseltter delivered to your inbox every month.

Search the Insights Blog

How to invest with us

Click the button below to learn how you can get started with Motley Fool Asset Management