Our Parent Company

You might already be familiar with our parent company, The Motley Fool, LLC, and their mission to make the world smarter, happier, and hopefully richer.

The company was founded by two brothers—and now well-known investors—Tom and David Gardner in 1993.

The Motley Fool, LLC boasts a decades-long track record with over 30 years of timely stock picks and financial education for do-it-yourself investors.

The Foolish investing philosophy is built upon the fundamental principles of buy-and-hold investing for long-term outperformance. The goal is to let great companies work and succeed for you as you make money calmly, methodically, and over a lifetime.

The distinctive name is an homage to The Fool, or the court jester, who appears in Shakespearian literature—a silly but surprisingly sharp character who could give straightforward advice and wisdom.

By employing a diverse, vibrant community of analysts, The Motley Fool, LLC embraces the belief that “motliness” makes us stronger investors.

Our Story

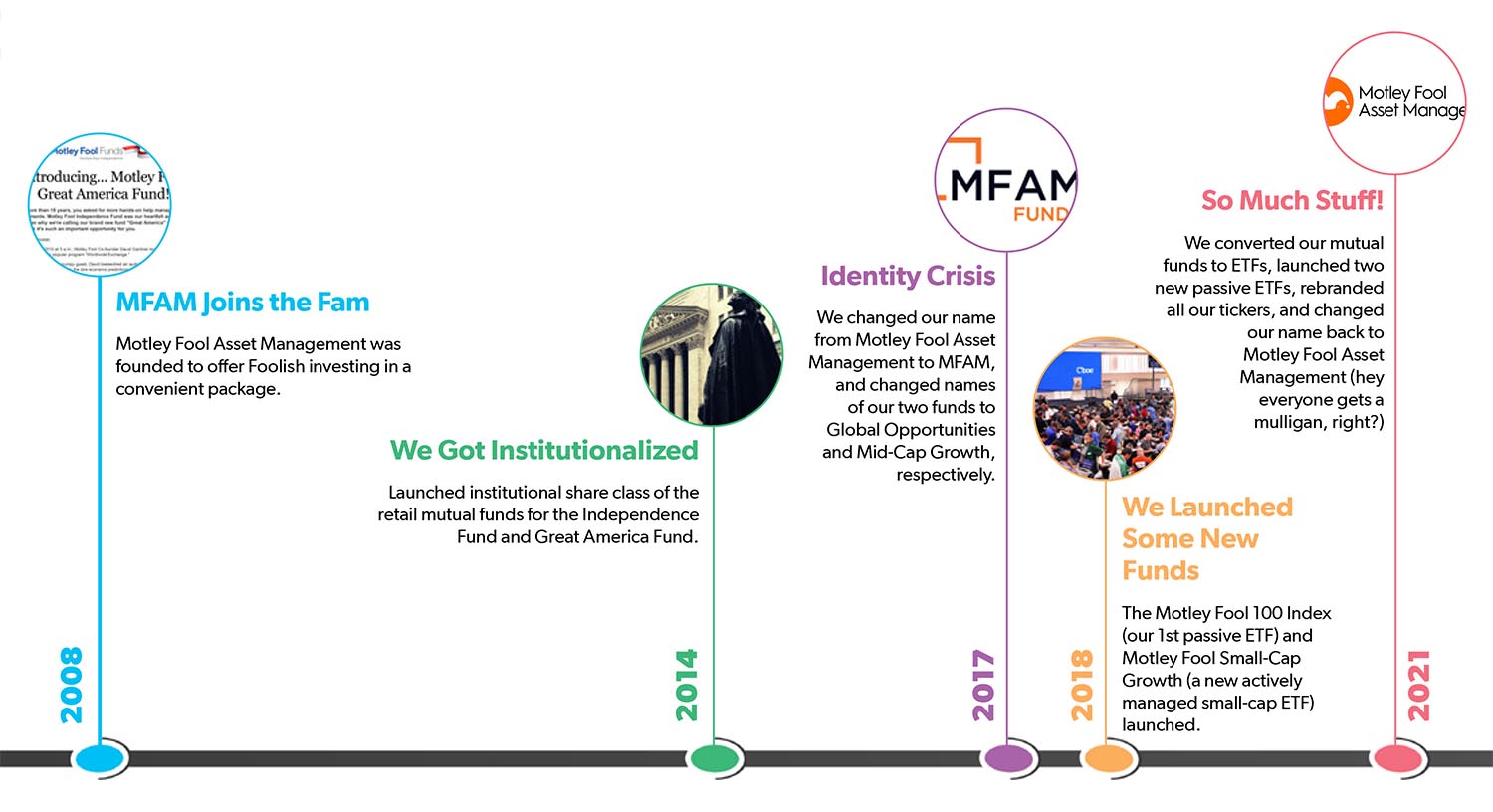

Many people love the principles of Foolish investing, but don’t want to manage their own portfolios. So in 2008, we founded Motley Fool Asset Management as an independent subsidiary of The Motley Fool, LLC, offering investors a way to put the Foolish philosophy to work without having to pick stocks themselves.

We assembled a team of experienced Portfolio Managers who have come up through the investing ranks of The Motley Fool, LLC and built a whip-smart, Motley crew of investors with varied backgrounds, interests, and specialties.

Today, we are charged with discovering what we believe to be the very best quality stocks in the marketplace to include them in our ETF products.

We proudly offer three actively managed ETFs, and three passive ETFs.

Together, our products can work in combinations to potentially create a complete, well-diversified equity portfolio. Individually, they can add additional layers of diversification that can differ from broad market performance.

Our funds' Foolish history

So, why us?

There are thousands of ETFs on the market. Why are we in this game?

The Fools behind the scenes—The Motley Fool, LLC analysts picking stocks to include in our indices and the Motley Fool Asset Management active Portfolio Managers—are what make us special. Unlike other ETFs that simply follow the market and rely solely on roboadvisor technology, our team believes that a human element should be a part of investing, especially in a pooled fund with holdings that are meant to complement one another.

When considering potential investments for our ETFs, we seek quality above all. Quality may seem like a vague term, but to us and in the world of investing, it means something very specific. It’s a 360-degree investment approach that takes into account both quantitative and qualitative factors.

We call our proprietary approach the Four Pillars of Quality.

Algorithms can run the numbers on revenue, P/E ratio, profit growth, etc. But they tend to struggle when it comes to assessing factors like management credibility, brand loyalty, and company trajectory.

We believe that taking into account qualitative—or “soft”—data, along with the hard numbers gives us an advantage when it comes to discovering the companies that have the most wealth-building potential for our ETF shareholders.

If you believe in investing selectively in businesses that have what we feel are easy-to-understand revenue models, clear competitive advantages, great management teams, strong corporate cultures, and long runways for potential growth, then we invite you to invest with us in one or many of our convenient, cost-efficient ETFs.

How to buy our ETFs

Getting started is easy! Click below to see how you can add Motley Fool Asset Management ETFs to your portfolio.